In Nigeria’s vibrant FinTech landscape, where innovation is the norm and rapid adaptation is crucial, implementing agile development practices is not just advantageous – it’s essential. Agile methodologies empower Nigerian FinTech startups to respond swiftly to market demands, iterate on products efficiently, and deliver exceptional solutions that meet customer needs. In this blog post, we’ll delve into actionable strategies for implementing agile development practices in Nigerian FinTech startups.

Read more about FinTech

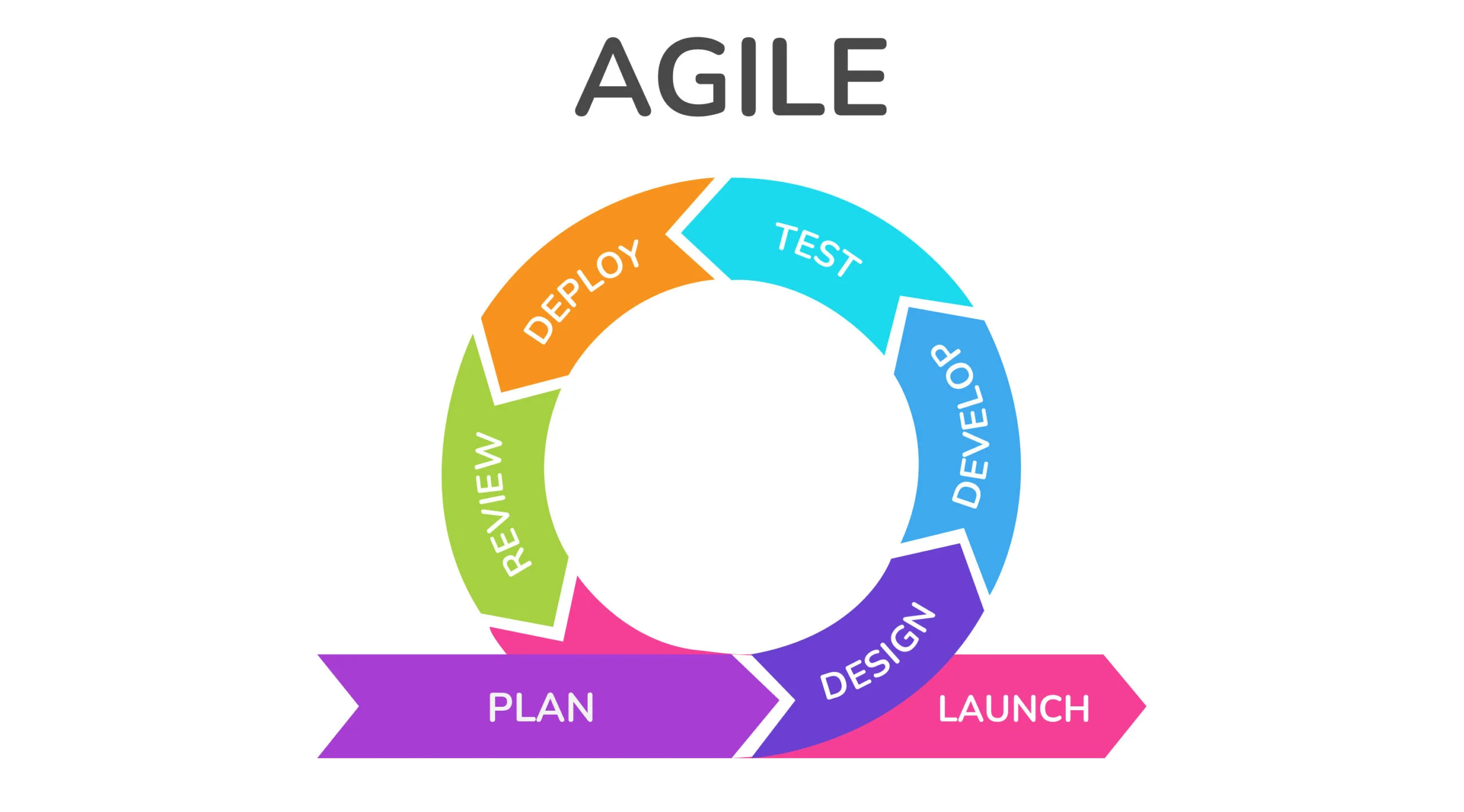

Understanding Agile Development

Before diving into implementation strategies, it’s essential to understand the core principles of agile development. At its heart, agile is a mindset that prioritizes flexibility, collaboration, and continuous improvement. Agile methodologies, such as Scrum and Kanban, emphasize iterative development, close collaboration between cross-functional teams, and a focus on delivering value to customers quickly.

Start with a Clear Vision and Roadmap

The journey to agile transformation begins with a clear vision and roadmap. Nigerian FinTech startups should articulate their long-term goals and objectives, as well as the strategic initiatives required to achieve them. A well-defined product roadmap provides a guiding framework for agile development, helping teams prioritize work, allocate resources effectively, and align their efforts with the overarching business strategy.

Foster a Culture of Collaboration and Transparency

Effective collaboration is at the heart of agile development. Nigerian FinTech startups should foster a culture of collaboration and transparency, where cross-functional teams work closely together towards common goals. Daily stand-up meetings, regular sprint planning sessions, and retrospective meetings facilitate communication, alignment, and accountability among team members. By breaking down silos and promoting open dialogue, startups can unleash the collective creativity and expertise of their teams.

Embrace Iterative Development Cycles

Agile development is characterized by iterative development cycles, where work is broken down into small, manageable increments known as sprints. Nigerian FinTech startups should embrace this iterative approach, delivering value to customers incrementally and adapting their plans based on feedback and changing market conditions. Shorter development cycles enable startups to respond quickly to evolving requirements, mitigate risks, and deliver tangible results at a rapid pace.

Sign up for the Connect Nigeria daily newsletter

Prioritize Customer Feedback and Validation

Customer feedback is a cornerstone of agile development. Nigerian FinTech startups should prioritize gathering feedback from customers early and often, incorporating it into the product development process iteratively. User testing, prototype demonstrations, and beta releases are effective ways to validate assumptions, identify pain points, and refine product features based on real-world usage. By listening to customer needs and preferences, startups can ensure that their solutions are truly customer-centric and deliver maximum value.

Embrace Continuous Integration and Deployment

Continuous integration and deployment (CI/CD) practices are fundamental to agile development. Nigerian FinTech startups should automate the process of integrating code changes, running tests, and deploying updates to production environments seamlessly. By automating repetitive tasks and minimizing manual intervention, startups can accelerate the pace of development, reduce the risk of errors, and deliver high-quality solutions more reliably. CI/CD pipelines enable startups to iterate rapidly, experiment with new features, and respond quickly to market feedback.

Foster a Culture of Experimentation and Innovation

Agile development thrives on experimentation and innovation. Nigerian FinTech startups should create an environment where experimentation is encouraged, failure is embraced as a learning opportunity, and innovation is celebrated. Hackathons, innovation labs, and cross-functional brainstorming sessions provide fertile ground for exploring new ideas, testing hypotheses, and pushing the boundaries of what’s possible. By fostering a culture of experimentation and innovation, startups can stay ahead of the curve and drive continuous improvement in their products and services.

Measure Progress and Adapt Accordingly

Effective measurement and feedback mechanisms are essential for gauging progress and adapting strategies accordingly. Nigerian FinTech startups should establish key performance indicators (KPIs) aligned with their strategic objectives and track them rigorously throughout the agile development process. Regular retrospectives enable teams to reflect on their performance, identify areas for improvement, and adjust their approaches accordingly. By measuring progress against predefined metrics and adapting strategies based on empirical data, startups can continuously refine their processes and optimize their outcomes.

Register to attend the CN Business Mixer

Conclusion

In Nigeria’s dynamic FinTech landscape, implementing agile development practices is essential for driving innovation, delivering value to customers, and achieving sustainable growth. Nigerian FinTech startups that embrace a clear vision and roadmap, foster a culture of collaboration and transparency, embrace iterative development cycles, prioritize customer feedback and validation, embrace continuous integration and deployment, foster a culture of experimentation and innovation, and measure progress and adapt accordingly can unleash their full potential and thrive in the fast-paced world of FinTech. By embracing agile principles and practices, Nigerian FinTech startups can navigate uncertainty with confidence and chart a course for long-term success.

Got a suggestion? Contact us: [email protected]