Every country needs money to run, the money used in carrying out various activities of a country is needed is public Finance. The term public means government and the term finance means the science of management of money.

Read more about Finance

Therefore, public finance means the study of allocation and management of resources and technology for achieving the goals of public organizations.

It involves the country’s revenue, collection of various taxes, returns on the investment, and government expenditure such as healthcare, medical facilities, salaries to the staff, members, etc.

Public Finance assesses the government revenue and government expenditure and the adjustment of one or the other to achieve desirable effects and avoid undesirable ones.

Undoubtedly, public finance plays a special role in promoting economic growth in developing countries like Nigeria.

The government of a country can push up the industrial and economic development of the country, provide more employment opportunities, and encourage investments and savings in the desired direction through public expenditure.

The overview of public finance is threefold, consisting of governmental effects on:

The efficient allocation of available resources

The distribution of income among citizens

The stability of the economy

Objectives of Public Finance

Managing Public Needs: The main objective of public finance is managing the basic needs of the public like food, shelter, health, infrastructure, and education.

Sign up for the Connect Nigeria daily newsletter

Economic Development: Proper management of public finance leads to economic development that leads to the nation’s growth.

Removing Inequality: One of the aims of public finance is to remove inequality by proper allocation of resources i.e. providing relief to the poor.

Maintaining Price Stability: Inflation is controlled when there is proper management of public finance, and then prices of goods and services can remain stable.

Analyzing the need for Debt or Investment: Another important aim of public finance is to analyze whether there will be a shortage of funds or availability of excess funds and accordingly deploy the funds.

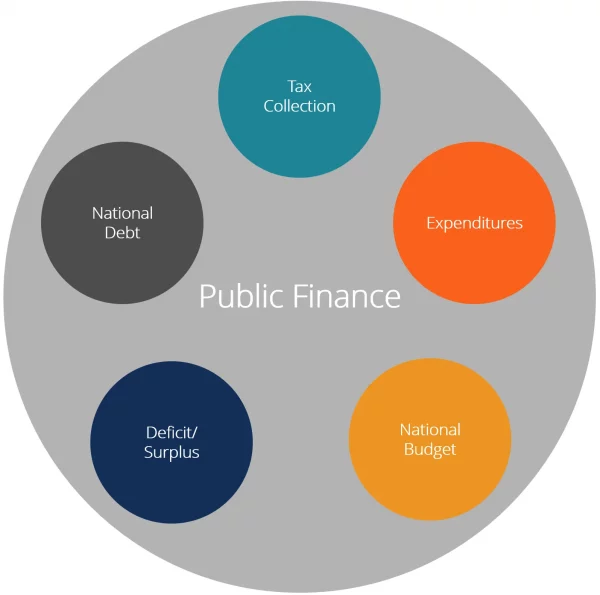

Types of Public Finance

All the concepts of public finance relate to either collecting revenue, making expenditures to support society, or implementing a financing strategy.

Public Revenue: Gotten from collecting money from the public through direct and indirect taxes, sales tax, income tax, estate tax, property tax, penalties, fines, fees, maintenance, etc. That way, the government raises funds from the public and for the public.

Public Expenditure: This refers to government spending for the public through various means such as providing infrastructural facilities, basic health facilities, medical and educational facilities, etc.

Register to attend the Connect Nigeria Business Mixer

Public Debt: When the expenditure exceeds the revenue,(spending is greater than revenue), it will fund the difference by borrowing money and issuing national debt to fulfill the country’s needs and run the economy.

Financial Administration: This is simply the management of public finance and addressing the needs of the government like salaries to the general electives, expenditure on maintenance of communal heritage, etc.

Functions of Public Finance

Management of income and expenditure by optimal utilization of the resources.

Providing the necessary needs and infrastructure to the public.

Take initiatives for the development of the people, which can contribute to the nation’s development.

Preparing the economic policies for the nation’s development and the economy at large.

Featured Image Source: Corporate Finance Institute

Got a suggestion? Contact us: [email protected]