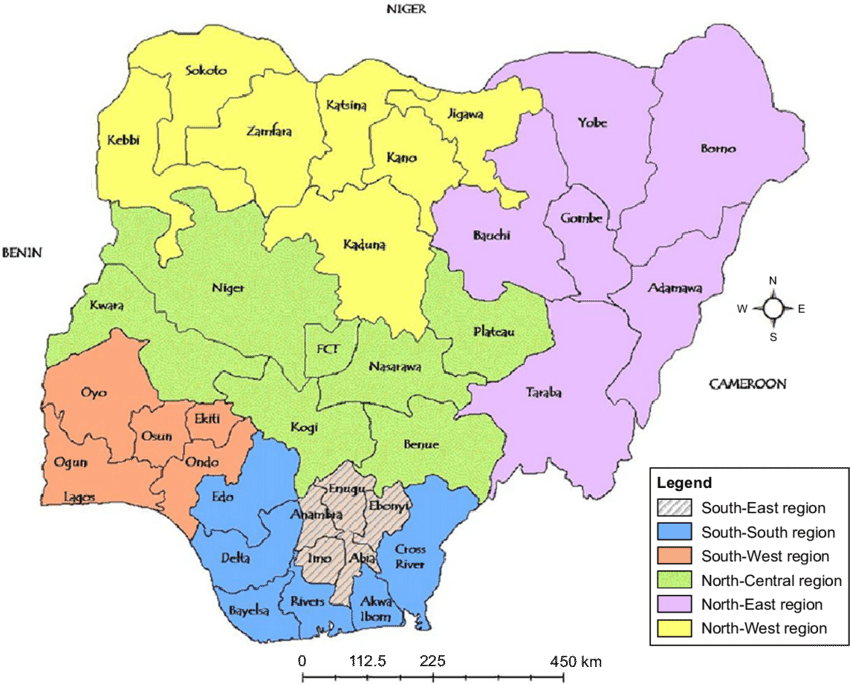

One of the factors loosely connected to the quality of life of a population is how financially inclusive the people are. The political and educational peculiarities of each of the 6 geo-political zones become evident in how financially savvy the people.

Read more about Politics

Financial inclusion is a fundamental element that converts the economic growth of a country to how accessible people find finance. In an optimally functioning economy, once economic agents enable people to make long-term consumption and investment decisions while engaging in productive activities, they are better able to effectively cope with unexpected emergencies.

As far back as 2012, the National Financial Inclusion Strategy committee set targets to reduce the levels of financial exclusion across the nation.

Meanwhile, there have been some gains in the area of financial inclusion on a macro level. More citizens are gaining financial mobility through the use and adoption of financial technology but not at a rate optimal enough for development.

A breakdown of the financial inclusion data on geopolitical arrangements tells a different story. EFInA data in 2018 indicates that North West Nigeria has the highest financial exclusion rate of 62%. Closely following is North East with 55% while North Central Nigeria has the 3rd highest at 31%.

Of the 3 other geo-political zones in Southern Nigeria, the South East possesses about half of North West’s 62%. The South-South geo-political zone has 23% while South West maintained a 19% financial exclusion rate.

Sign up to the Connect Nigeria daily newsletter

Financial inclusion in Nigeria remains uneven. It is also evidently interwoven with the political reality each zone experiences. For instance, financial exclusion rates are significantly higher in North East and North West Nigeria, whereas Southern geopolitical regions have better financial exclusion rates. In general, rural populations have a higher financial exclusion rate than urban areas.

Whereas, the demographic characteristics of Northern Nigeria indicates that there are more rural areas in the North than there are in Southern Nigeria.

Recent research disclosed that the National Financial Inclusion Strategy committee is closer to achieving its 20% exclusion rate in the Southern geopolitical zone than the Northern geo-political zones.

The research also noted that for the National Financial Inclusion Strategy committee to attain its 2020 financial inclusion target in Nigeria, the focus should rather be shifted to increasing financial access in the rural areas since over 60% of Nigeria’s population live in rural areas.

The data also shows another variable of educational penetration in each of the geo-political zones to influence how financially inclusive the people find themselves.

One direct method to achieve financial inclusion is by the use of branchless banking, improving digital finance infrastructure and designing financial products/services that are tailored to meet the needs of the rural populace.

If the respective state governments in the under-performing geo-political zones experiencing the larger percentage of financial exclusion can institute policies that will improve education in their region; financial inclusion will also significantly increase in the more excluded states in North West and North East.

Featured Image Source: Research Gate

Got a suggestion? Contact us: [email protected]