Diamond Bank Plc has announced a 29 per cent increase in its profit after tax, PAT, to 28.5 billion for the full year ended December 31, 2013.

The bank also stated that for the same period, it recorded a 16.7 per cent increase in profit before tax to N32.1 billion.

In a statement made available to Connect Nigeria, the bank proposed a dividend of 30kobo per 50 kobo ordinary shares.

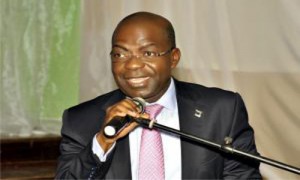

The group managing director of the bank, Dr. Alex Otti was quoted saying “we are pleased to announce that Diamond Bank has exceeded its N30 billion in 2013. This result is rooted in our strength to attract low cost deposits and deploy these into various assets at profitable yet acceptable risk levels”.

The GMD further added; “Despite the challenging operating environment, we continue to advance our advantage with above industry balance sheet growth. We will continue to explore all opportunities to grow our business and market share responsibly as leverage on our growing customer relationships enhanced by our expansive delivery channels and excellent service delivery”.

The bank achieved a net interest income of N104.6billion- up 17.1 per cent from N89.3 billion recorded in 2012; it generated interest and similar income of N143.1 billion- up 27.3 per cent from N112.4billion earned in 2012. Diamond bank also achieved a 46.2 per cent increase in other income from N23.8 billion in 2013.