7 Tips for a FinTech Looking to Partner with Banks

In the dynamic landscape of financial technology (FinTech), forging strategic partnerships with established banks can be a game-changer for startups. Collaborating with banks not only brings credibility and stability to a FinTech venture but also provides access to a vast customer base and a wealth of industry expertise. Read more about FinTech However, successfully […]

10 Things Banks Are Doing That FinTechs Should Adopt

We can’t deny the fact that the banks have legacy structures that puts them ahead of many FinTechs, especially in Nigeria and beyond. For one, banks have a lot of sophisticated relationships with the government as well as regulators. Second, having been in operation much longer than FinTechs, banks have been able to earn […]

7 Facts About Nigeria’s FinTech Industry In 2022

Nigeria’s FinTech industry has grown rapidly over the past decade. Starting out with just a handful of payments companies, it’s expanded on all fronts and now includes multiple segments, each with a large number of players. The space is populated by hundreds of startups, with many new ventures emerging every other year. Read more […]

The Best Companies And Banks To Buy Stocks

The term “Stock” is familiar in the finance world, which means the total shares of a company held by an individual shareholder. In Nigeria, before you buy stocks from any company, you have to know that you can only buy and sell stocks through the public companies that form the Nigerian Stock Exchange in Nigeria. Read […]

5 Ways Big Data Can Transform FinTech

The finance industry generates huge amounts of data– more than most segments of a typical economy. From personal bio-data to financial transactions, accounts and savings habits, these institutions yield information on a mind-bogglingly large scale. Read more about FinTech This set of data is a treasure trove. FinTechs, banks, and other players in finance could […]

The Responsibilities Of Banks To Their Customers

A bank is a financial institution which is involved in borrowing and lending money. Banks take customer deposits in return for paying customers an annual interest payment and it then uses the majority of these deposits to lend to other customers for a variety of loans. The difference between the two interest rates is […]

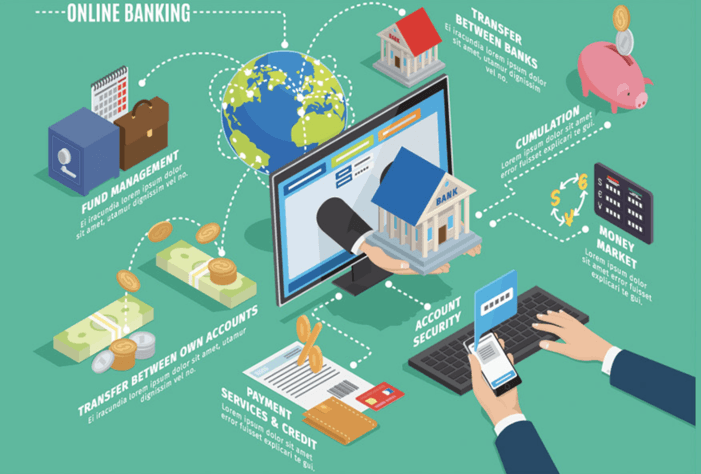

6 Things To Consider Before Choosing A Digital Bank For Your Savings

Digital banks have become a favourite tool for tech-savvy Nigerians who want to save their money at little cost to themselves. These banks are easier to access than traditional financial institutions; customers can access their products and services via apps that grant access to their mobile platform. Read more about Fintech However, if you’d like […]

Innovation Strategies For The Banking Sector

Innovation is creating something novel—through creativity—in contrast to the status quo or the modus operandi of a system or a given cultural milieu for its growth and profitability. To stay afloat in an evolving and competitive system like the banking sector, it’s wise for any bank that wishes remain relevant or be at the top […]

Can Fintech Replace Banks?

In this growing era of technology, technology has in one way or the other replaced some sectors of the economy, however, there is a strong chance that this replacement might cut across the banking sector as well. Read more about Fin Tech Overtime, there has been an incredible increase in the number of new FinTech […]

Relationship Between Banks And Fintech

Overtime, consumers have tolerated the lack of technology experienced in banks, and with the rise of Fintech, banks are now struggling to keep up and offer customers the innovation they desire, because Fintech is bridging the gap between what banks offer and what the modern consumer has grown to expect. Read more about Fin Tech […]

Did You Know? Nigeria’s Top States and Banks for Foreign Investors

Every quarter, the National Bureau of Statistics (NBS) publishes its report on the amount of foreign investment coming into Nigeria. The Nigeria Capital Importation report, as it’s called, provides a glimpse of investment inflows into states, banks, and economic segments in the country. Earlier this year, the NBS put out its Capital Importation Report for […]

Top 5 Nigerian Banks of 2019

It’s been a mixed year for Nigerian banks. Some have seen their profits bulge; others have had to lay off a large fraction of their workforce, just to maintain decent margins. There were expansions into new regions; a huge merger was completed; and the general shift to digital banking continued. And in the world beyond […]

Family Businesses in Nigeria: FCMB Group

First City Monument Bank Limited is a full-service banking group that offers personal, business and corporate themed financial services to customers. FCMB Group aspires to become Africa’s premier provider of financial services by delivering superior and sustainable returns to its shareholders. Founder of FCMB Limited, Oloye Subomi Balogun was born into a Yoruba noble family […]

Nigeria’s Banking Industry: Central Bank of Nigeria

The Central Bank of Nigeria (CBN) is the institution legally charged with overseeing Nigeria’s banking sector. It controls the country’s monetary and fiscal policy, is in charge of the foreign currency reserves, and acts as banker and financial advisor to the government. The nature of the apex bank’s interaction with Nigeria’s banks has changed over […]

Nigeria’s Banking Industry: Polaris Bank

Polaris Bank is one of Nigeria’s most recently founded financial institutions. Established by the CBN in 2018, it provides financial services to millions of people and businesses in the country, through its many offices, ATM outlets, a mobile app, and on the internet. The company was actually founded as a ‘bridge bank’ to manage the […]

Nigeria’s Banking Industry: Fidelity Bank

Fidelity Bank is a first-tier commercial bank offering financial services to over four million customers, predominantly in Nigeria. It’s been a savings haven for numerous individuals for more than two decades, and for almost thirty years, it has assisted local businesses with the financial support they need to scale. Although it started out on the […]