Diamond bank has just recently launched a powerful Artificial Intelligence powered chatbot that you can interact with through Facebook’s messenger app. Diamond bank sent out a mail to its customers introducing the new ‘personal banker’. Funny enough, at first I thought I had been assigned a new account officer named Ada, but not so, Diamond bank is intentionally adapting new technologies (like AI and chatbots) that will make it easier for customers to utilize the services they offer.

‘Ada’ (or Aunt Ada) is a chatbot that uses Artificial intelligence to offer banking services to diamond bank customers. AI technology relies on a machine’s ability to learn from experiences and be able to use the information from those previous data sets to present better results and or performance in future cases of the same event, just like humans. Since Ada is powered by AI, you’ll expect to get a personalized human-like experience and interaction just like you would if you were interacting with a real banker.

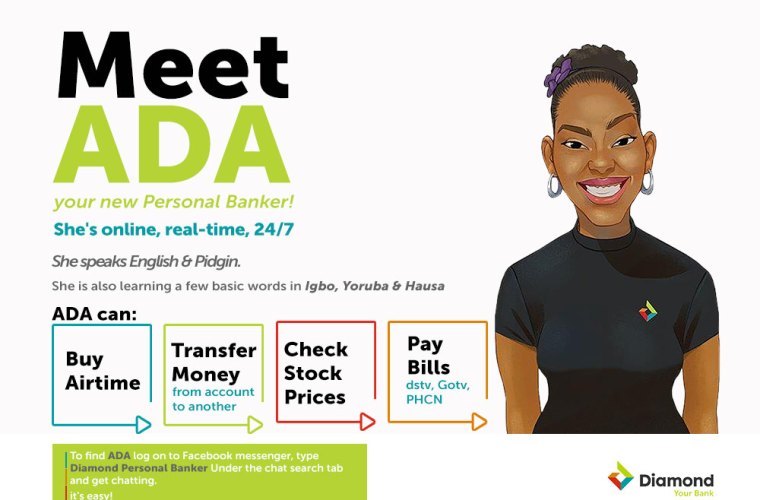

What can Ada do?

Ada can process transactions including airtime purchase, bill payments, stock trading, and money transfers all via Facebook Messenger. Diamond bank promises that our favorite personal banker – Ada, will be available on other messaging platforms in the coming months.

Basically, you can now perform simple transactions just by chatting with Ada. This feels really cool. It’s just like being able to talk to a real banker to help you make transactions. Except this time, Ada is available 24/7 and will give you all the attention you require, unlike, well, that real banker. If you’ve had some experience using Siri or Cortana or Google assistant, you probably already get the gist.

In case you were wondering what language Ada speaks, she’s fluent in English and Pidgin but is still learning the basics of Igbo, Yoruba, and Hausa.

Chatbots and other AI-powered platforms and solutions are essential in today’s mobile-driven economy that already shows preferences for digitally delivered services. Diamond bank is looking to have more customers engaging with its mobile services for a more personal banking experience.

In the advent of more ‘Adas’ springing up in the banking industry, people will finally leave the banking halls and do their banking at home, on the road, or wherever at their own convenience.

So, what now happens to the actual bankers?