Nigeria has a huge housing deficit problem.

One figure from 2015 suggests that the country has a housing gap of over 17 million units. Closer to the present, the head of the Federal Mortgage Bank of Nigeria (FMBN) has said that the deficit now stands at about 22 million.

Read more about How To

In simple terms, there are a lot more people looking for decent accommodation than there’s housing to accommodate them. The gap grows every year, indicating that the country isn’t keeping pace with this challenge either.

Why does this problem exist?

The Contrast That Stares Us In The Face

The shanty-filled slums that encircle our cities are supposedly evidence of our housing crisis (if it’s right to call it one). Collectively, they are home to millions of people; they are so big that they define much of our urban environment.

But there’s another side to our metropolises: the plush estates, which cost billions of naira to construct. There’s more to the contrast between these two realities than just penury and opulence. While the slums are crowded and expanding, the luxury estates are largely empty.

But even the less fancy homes are priced beyond the reach of the average working individual or family. According to the Nigerian Property Centre, the average annual rent for properties on the outskirts of Lagos (Ipaja, Ijaiye, Ikotun, Ikorodu) is about ₦400,000. For Ikoyi, middling rents are about ₦8 million.

We are building a lot of houses; not just the kind that most Nigerians can afford. Perhaps the problem isn’t merely the absence of housing. It’s also a deficit in decent and affordable living space.

Why Are Property Prices So High?

The big culprits here are the high cost of building materials and an abnormal level of property speculation in urban and semi-urban areas. The price of building materials, like that of every other commodity, is subject to inflationary pressure. Nigeria has a long-running challenge with inflation; we’ll refer to it again shortly.

But it’s been suggested that the high price of building materials also comes down to price-fixing by the dominant suppliers (cement comes to mind), and the cost of importing materials (for more upscale homes).

Property speculations have a hand in this too. They buy properties just to sell them at a higher price soon after. As the chain of speculation grows longer, so does the price of the property involved. As a result, real estate prices become volatile.

These aren’t the only factors we should consider.

Sign up to the Connect Nigeria daily newsletter

Inflation And An Underdeveloped Mortgage Industry

What if we tried to solve the shortage of living space by encouraging more people to seek out mortgage financing? This would enable them to fund the building of their own homes.

Unfortunately, the Nigerian mortgage industry isn’t as developed as its counterparts elsewhere in the world. Between 1960 and 2014, there were only about 200,000 mortgage transactions carried out in the country. Given the size of Nigeria’s housing deficit, 200,000 transactions aren’t worth much fanfare.

What’s more, mortgage interest rates are also quite high. In 2020, the average mortgage interest rate in Nigeria was 25%. Apart from the Federal Mortgage Bank of Nigeria (which offers single interest rates) all mortgage banks in the country present double-digit interest rates for their facilities.

These interest rates are so high because the banks want to achieve real returns on their loans. Because inflation is so high (about 18.2% at the moment), mortgage institutions set their interest higher, to beat it. If their interest rate is at 25%, they earn a real return of about 7%.

If we are going to keep interest rates affordable for most borrowers, we’ll have to solve the inflation problem.

Solving The Housing Deficit

So far, the government’s principal answer to the housing deficit has been the National Housing Fund (NHF).

In 2019, the National Assembly passed the NHF Establishment Act, which repealed an earlier NHF Act. The law mandates all employers earning above minimum wage to pay 2.5% of their monthly income to the NHF, deducted through their employers. Self-employed people were also expected to pay 2.5% of their income into the fund.

Contributors to the fund can apply for mortgage financing from the Federal Mortgage Bank of Nigeria (FMBN). If their application is approved, they will be able to build their own homes, with support from the FMBN.

But the government can’t solve the housing gap this way; certainly not by itself. It would cost it more than ₦6 trillion annually to plug the deficit—almost half the country’s current budget. It will need to work with private sector interests to achieve this.

One interesting idea we could adopt is the use of building materials other than the traditional ones. For example, shipping containers may be fashioned into houses. Several entrepreneurs are already doing this. We will need a lot more alternative solutions.

One gets the sense that this housing deficit will be dealt with if the underlying economic issues are resolved. If inflation is curbed, annual rents will ease, and mortgage rates will fall. The incentive to speculate on the property will be reduced. We can only hope that government will adopt policies that tackle this challenge from its roots and do so soon enough.

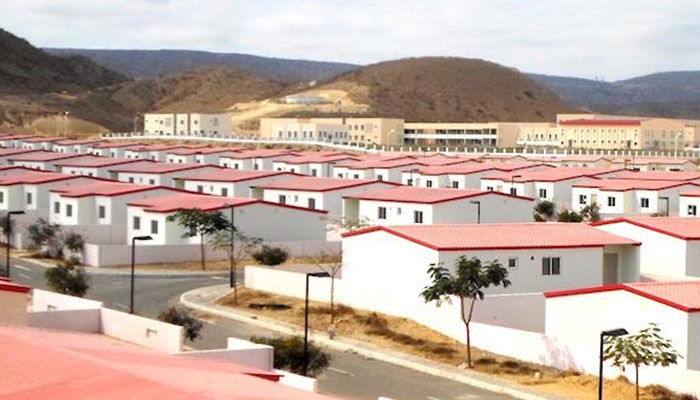

Featured Image Source: Construction Review Online

Got a suggestion? Contact us: [email protected]