Earlier in June, the Central Bank of Nigeria announced that it was doing away with the long-standing fixed exchange rates for the naira. In a disclosure that grabbed headlines nationwide, the apex bank said that it would now float the local currency, i.e. allow market forces (demand and supply) to determine the rates for which the naira would trade against foreign currencies. It also moved to unify the disparate exchange rates (I & E, and parallel market rates) that had previously existed.

Read more about Business

In the days following the implementation of this policy pivot, the naira depreciated in major global currencies. At the time of this article’s writing, a dollar was exchanged for about ₦770. That’s more than a 67% drop in value relative to the greenback compared to what was obtained just a month ago (when US$1 officially equalled ₦461).

Free or Managed Float?

Closer to the present time, the CBN has clarified that its new foreign exchange (FOREX) policy is a managed float. This means that it will occasionally intervene in the FOREX market to stabilize exchange rates by supplying it with foreign currency. And it has already done this at least once. Regardless of the form that its policy takes, it is already starting to affect businesses in the country.

How the Naira Devaluation is Affecting Nigerian Businesses

Nigeria is heavily dependent on imports. Businesses spend billions of dollars in scarce FOREX annually to purchase raw materials, equipment, and finished goods. The devaluation of the naira means that these items will become more expensive. It is driving up their operating costs. Because much of the local customer base has a low purchasing power, businesses affected struggle between raising product prices and keeping buyers happy. Unfortunately, many companies may fail at juggling both these necessities and eventually have to close shop.

How Your Business Can Survive the Naira Devaluation

If you are an entrepreneur, you will want to avoid the fate we’ve described above. Much of the evidence we have suggests that the naira will slump further against key foreign currencies over the coming weeks and months. There’s a good chance that a dollar could exchange for close to ₦1,000 in the not-to-distant future. So you’ll want to be prepared for this eventuality. In this article, we’ll have a look at 10 steps you can take to protect your business from unstable FOREX rates. Here they are, listed in no particular order:

Stock Up on Inputs and Other Crucial Needs

Indeed, costs have already gone through the roof. But you can be certain of this: they will climb even higher. Now is the time to hedge against further increases in the prices of important inputs and equipment. You can do this by purchasing essential supplies in bulk, whether they are raw materials or an inventory of goods that you’re going to resell at a later date.

Perhaps you’re already short of funds and are wondering how you’re going to replenish your raw materials or other items. It’s a good idea to seek lines of credit from your vendors. Get them to agree to fixed prices for the goods you’re obtaining from them, and have this agreement documented for future reference, just in case the need arises. Make sure the prices you agree on are close to what currently obtains at the markets.

Here’s why the above strategy will work. We expect the prices of inputs and finished products to carry on rising. If you fix the prices of the goods you’re obtaining on credit from your vendors at today’s rates, you’ll be paying today’s prices for those items in the future. And those prices you’ll pay will be less (maybe considerably lower) than what they’ll be in tomorrow’s markets.

For example, your vendor agrees to provide you with 10 boxes of print paper on credit. You both agree that you’ll pay her ₦150,000 about 5 months from now at most. ₦150,000 is the current price of that product. But when you do pay ₦150,000 for the boxes of print paper in 5 months, their market price is ₦200,000. So you would have saved your business ₦50,000. This strategy will work for a lot of goods, so you should consider going with it.

Find Less Expensive, Local Alternatives to Imported Inputs

If your company is anything like most in Nigeria, you’re probably using at least one item that’s imported. And if you purchase that item directly from foreign suppliers, you’d know how difficult it is to get them at affordable prices from international markets.

Your next best bet would be to find less expensive local substitutes. While this isn’t always feasible, you’d be surprised at how many of the goods you’ve previously purchased from abroad are available here in Nigeria. You just have to look for them.

This shift happens fairly frequently when FOREX troubles strike. In 2017 for instance, a weakening naira forced local manufacturers to seek raw materials from domestic producers, including farmers. Their action pushed total local content to over 60% of inputs used. It ultimately saved many of them from going bust.

Just this year, Unilever disclosed that it was turning to Nigerian producers for such inputs as sorbitol and spices, which it had previously obtained from India and China. It has been said that this move saves it a significant amount in shipping costs, reduces its carbon footprint, and allows it to forge closer partnerships with local vendors. Your business could reap similar gains by voting for Nigerian suppliers with your wallet.

Use Forward Contracts to Lock in Favourable Exchange Rates

As we’ve predicted, the naira will very likely depreciate further against major global currencies including the dollar. Now, what if you were able to buy dollars—or some other foreign currency –in the future, at lower rates? Here’s the good news: you actually can.

This is possible with what’s called a forward contract. It works like what we earlier described for goods obtained on credit, with the value of future payments already fixed today. In a forward contract, a vendor of US dollars British pounds, or other key currencies, can agree today to sell their foreign currency to a buyer in the future at a specific rate. If the rate both parties agree upon turns out to be lower than the market rate at the time of payment (in the future), the buyer would save the difference in naira.

Here’s an illustration. Let’s say you’ll need dollars to purchase equipment from the United States. But instead of getting the dollars today, you’ll agree with your dollar seller that they’ll sell it to you at a future date. And you both also agree on the price for which you’ll buy the dollars in naira—say $1 for ₦770. When that date comes, the market sells at the rate of $1 to ₦800. But because you and your seller have already agreed on the $1 to ₦770 rate, you’ll save ₦30 for every dollar on your transaction.

In Nigeria, you can take advantage of this through the Over Counter Foreign Exchange Futures (OTC FX Futures) market, which operates similarly to what we’ve just described. If you’d like to buy dollars at a future fixed rate, you can do so at a licensed Deposit Money Bank (DMB). This channel is available for a range of purposes, from import transactions to foreign currency loans.

Find Ways to Earn in FOREX

This rests on the assumption that the naira will keep sliding against the dollar in the short to medium term (subject to the CBN’s occasional interventions). A good way to stay ahead of the corrosive effect that this could have on your business is to earn in FOREX (dollars, pounds, etc.). Usually, this would mean exporting products to foreign markets.

Selling to more affluent markets overseas would allow you to earn more than you would if you only sold to a domestic customer base. This is because clients in those climes can typically afford to spend more on your offerings. With your prices marked up and denominated in dollars, and your products headed for Europe, the US, or East Asia, you’re bound to earn handsomely.

Admittedly, the process of preparing to export from Nigeria can be cumbersome and time-consuming. You have to get product standards right; obtain registration, regulatory, and trade insurance certificates; and learn about your target market(s) before starting. But on the flip side, the naira’s devaluation means that exports become cheaper for the destination markets, so they may be more inclined to buy from you.

It’s even easier to ‘export’ your offerings and earn FOREX for them if you’re selling non-physical products and services. For instance, if you’re selling software development services, digital designs, or courses, you can find international clients who are willing to pay several times more than local ones and do so in dollars. A solid eCommerce strategy, which is bolstered by great SEO tweaks and paid advertising, can take you closer to the global customers you seek. A strong social media presence that appeals to an international audience will also do the trick for you.

Sign up for the Connect Nigeria daily newsletter

Diversify Your Income Sources

One thing that a weaker naira will do is eat into your profit margins. That’s because you will struggle (and probably fail) to pass on the full cost of the devaluation to your customers. Thankfully, there’s a way to recover some of that loss: expanding the range of products and services you provide.

With more goods on sale, you’ll stand a chance of increasing your overall revenues. You could vary the prices of the new goods, which may represent different flavours, functions, or target demographic. Appealing to a broader range of buyers and tastes allows you to capture more value, relative to what you’ve previously achieved. In the end, it’ll show up in your bottom lines as a positive bump.

Apart from introducing varying versions of the same type of product (e.g. assorted flavours) you can sell completely different types of products and services. For instance, if you run a bakery business, you could begin baking courses for persons who want to learn to bake. You may do this offline in a physical environment, and online via webinars. If you’re great at what you do, you may even dare to sell these courses to customers outside of Nigeria and earn dollars for your efforts.

Besides putting out new products and services, you could try entering new markets. There may be locations or demographics that are low-hanging fruits for your business. For example, if you have been selling your detergents to a primarily mature adult female audience, you could begin a campaign to sell smaller versions of your product to students at universities and polytechnics near you. The earnings from each unit may be a fraction of your original offering, but they will cumulatively yield more revenue for you when added to what you’ve previously made.

Prune Overhead Costs

Because so much of our production needs are acquired from beyond our shores, a declining naira often means that our business costs soar. To remain a going concern, enterprises will have to trim excesses and shrink non-essential spending.

The first type of cost you should be looking to cut is overhead costs. This refers to expenses incurred while running a business, which are not directly related to the production or service provision process. Examples include rent, utilities, office supplies, equipment maintenance, technology expenses, and travel costs.

Your first step should be to review these costs, to determine which ones are vital and which ones aren’t. In reality, they will fall on various points of a spectrum that goes from ‘really important’ to ‘negligible worth’. You will aim to apportion fewer resources to acquiring and maintaining items closer to the latter end of that spectrum. A good look at your accounts will reveal what’s taking up your money, and what can be clipped with little consequence to your business’s daily operations.

There are a lot of steps you can take to prune overhead costs. The more impacted your business is by the naira devaluation, the more radical your moves need to be. They may range from adopting less expensive technology solutions to moving your office to a location that charges a lower rent. You may have to consciously curb your energy use (have appliances and equipment on only within office hours, for instance), and settle for more affordable office supply vendors, just to name a couple more adjustments.

Change Your Business Model

Depending on the severity of the shock that’s hit your company due to the naira’s devaluation, it’s probable that changing your entire business model (or tweaking it somewhat) will be the most appropriate response. Your operating model is basically how your business works—including all of its processes, and how they combine to deliver value to you, your shareholders, and your customers.

The components of your operating model are your people (employees), suppliers, production processes, administrative structure, technology systems, and customer-facing services. Transforming your model will involve things like redefining the makeup and hierarchy of your workforce, pivoting to a new approach to revenue generation, moving away from selling one product type to another, or changing your customer type or the sort of clients you serve.

Your shift could be as mild as embracing a more distributed work model, with your team members turning in results from across various locations; or as radical as transitioning from a B2C company to a B2B firm that sells a completely different product or service from what you’ve previously offered. Whatever step you choose, be sure that it’ll eventually make your business healthier financially, given the prevailing economic conditions.

Moniepoint is a well-known company that’s changed its focus and reaped benefits from it. Starting in 2019 as ‘TeamApt’, it initially provided internet banking services and payment infrastructure to banks. It has since pivoted, and now serves private businesses with payment solutions. In 2022, it had 600,000 businesses as clients and had a total payments volume exceeding $170 billion.

Another success story that’s resulted from a business model change is Klasha. It began as an e-commerce startup but later morphed into a FinTech that supplies e-commerce businesses with cross-border payment solutions. As of December 2022, it had over 2,000 merchants signed up with it.

The lesson here is simple: don’t be afraid to switch lanes if your current business model is severely impacted by FOREX instability.

Be Smart About Raising Prices

We have already hinted that raising prices at a time like this can be tricky. They too are reeling from the effects that the current exchange rate volatility is having on the broader economy. Yet, you have very little choice. You either increase your prices to at least cover your climbing costs, or get wiped out. How would you negotiate your way out of this difficult situation?

There’s one thing we need to be clear on your customers will be more forgiving of your price hikes if you’ve been selling them top-quality products and services. So you’ll want to deliver your absolute best with your wares and customer service before pegging your fees higher.

Instead of pushing an obvious increase in price to your buyers, you could reduce the volume of the product you’re selling for the same price. For example, if you used to sell a 200g packet of biscuits for ₦100, you may reduce the size to about 180g and sell it for the same price. You have probably noticed several companies do this (especially producers of Fast Moving Consumer Goods).

Admittedly, this move can be risky. There’s a chance that your customers will be irked by a reduction in product size and do their shopping elsewhere. To prevent this, you may reduce both the price and quantity of your product units. Taking the example of the biscuit pack above, you could go from offering 200g packets of biscuits for ₦100 to selling 150kg for₦80. That’s a price increase that won’t be noticed as much.

Psychological pricing—an approach that aims at appealing to buyers’ subconscious – will very likely work as well. One psychological pricing technique (called charm pricing) involves reducing the number of digits on the left-hand side of a price by one. For instance, instead of tagging your product (online or in your physical stores) with its price as ₦100.00, you can use a price tag that says it’s worth ₦99.99. Extensive research indicates that this technique works; it convinces customers to buy more products tagged in this manner. That’s why you see it used in a lot of online stores.

Switch to Alternative Energy Sources

PMS (‘petrol’) and diesel prices have risen sharply due to the recent removal of fuel subsidies by the Federal Government. As a result, most businesses which rely on these items for power (very likely including yours) have struggled to cope. Unfortunately, these staple fuels may become even costlier shortly, as newer supplies get imported at the present dollar-to-naira rates.

Register to attend the CN Business Mixer

If you want to shield your business from a sustained increase in the price of petrol, you should consider switching to alternative energy sources. The most commonly used option today is solar. While this may provide relief from an unreliable public grid, many MSMEs consider the initial purchase and setup costs to be on the high side. Nevertheless, there seems to be a sizable portion of players in Nigeria’s commercial landscape that are prepared to pay the initial price for future cost benefits.

A growing number of households and micro businesses are converting their PMS-powered generators to LPG power plants by replacing petrol engines with LPG engines. Liquefied gas is becoming a popular alternative to PMS because its price has dropped quite significantly in recent times. Between April and May alone, the price of LPG fell from ₦10,265 to ₦9,163—a 10.73% decrease. However, formal business establishments will probably avoid some of the engine replacement options available from local mechanics, due to the crude and unsafe forms they tend to take.

Casting our minds back to the point about diversifying income sources, you could even consider selling alternative energy to individuals and other enterprises, if you have the means to do so. This will be worth exploring in anticipation of the coming months when energy costs across the board will almost certainly gallop skywards.

Invest in Hard Assets

Everyone wants to preserve the value of their holdings. A sure way to do this in today’s economic conditions is to divest away from cash. If you have most of your long-term reserves sitting in a naira bank account, you can be sure that it’s losing its worth, and doing so very quickly.

You can stop this from happening by investing a good portion of your long-term savings in hard assets which appreciate over time. A good example is land. There are very few investments that beat the sort of returns you’ll get from land that’s situated in a prime or emerging real estate location. For context: land prices in Lekki Phase 1, Lagos, appreciated by a staggering 63% between 2019 and 2021 alone. Yields around real estate hotspots in Lagos State ranged from 22% to 51% within the same period. These results make a strong case for land (in the right vicinities) as a great way to hedge against inflation and currency devaluation.

Precious metals—gold, silver, and platinum, among others –are also a decent store of value. According to goldprice.org, the price of gold has rallied from below ₦500,000 per ounce in 2018, to ₦1.46 million as of the time of writing this article—an approximately 200% increase. Interestingly, close to half of this movement has happened in the wake of the CBN’s floating of the naira. It’s a sign of soaring demand for gold, driven by individuals and institutions seeking a haven for their funds.

A word of caution: you should treat investments in hard assets, especially precious metals, as a medium to long-term thing. Trying to ‘time the market’ by buying and selling quickly for outsized gain could backfire, and result in you losing a good deal of money.

Final Words

As long as Nigeria’s economy remains largely dependent on imports, its businesses will have to ride the wave of unstable exchange rates. The government at the Federal level is hoping that its move to float the naira will make foreign investors more interested in doing business in the country. Their investments, which will be denominated in global currencies, should bolster Nigeria’s FOREX supply, eventually stabilizing exchange rates. Until this happens, you can take the steps we’ve discussed here to save your business from the worst consequences of a devalued naira.

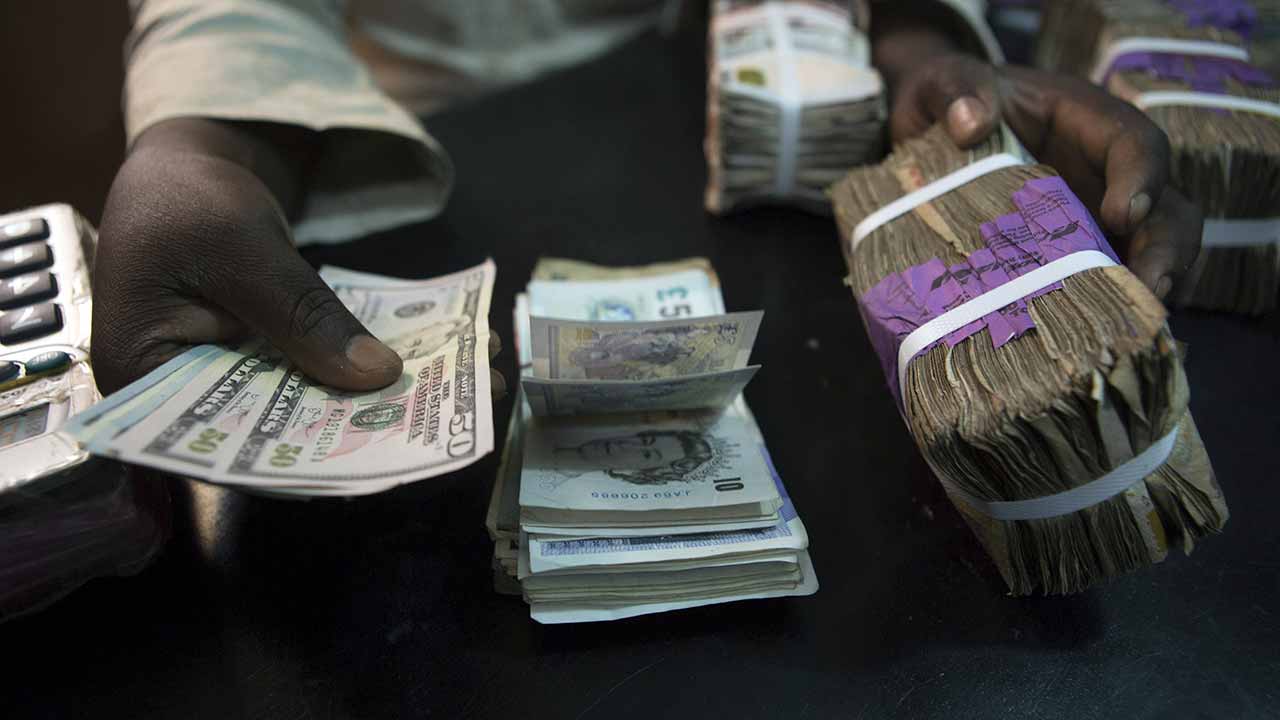

Featured Image Source:

Got a suggestion? Contact us: [email protected]