Customer interaction with businesses progresses in stages. Knowing what those stages are as outlined in marketing course textbooks is one thing; being able to deal with the peculiarities and complexities of the real world is quite another. A constantly evolving business environment demands more. As the dynamics of the business world change, old techniques become obsolete and are either adjusted or ultimately abandoned for new, more efficient and effective ones.

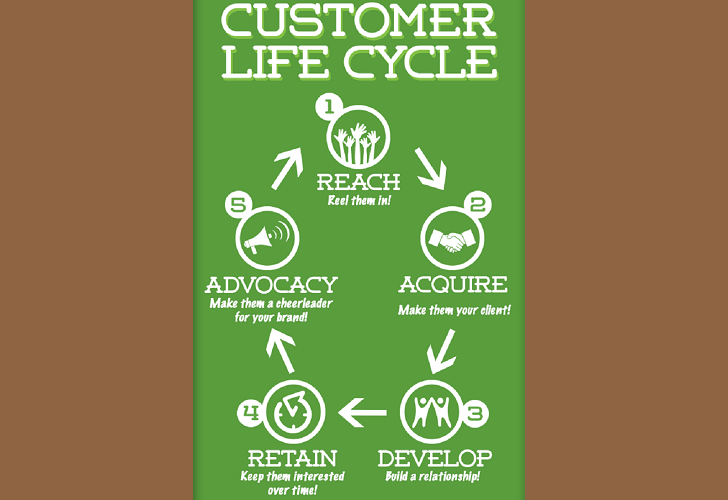

Today’s marketplace is said to be customer-oriented (actually, it’s probably more accurate to say that there’s more open talk about meeting customer’s needs). This, being due in part to fierce competition, has precipitated moves to come up with strategies to attract more potential customers and turn them into loyal customers. Customer Lifecycle Management (CLM) takes measurements of multiple customer-related metrics which are analysed over a period of time to obtain an indication of business performance. Consider a typical customer lifecycle: I hear about a product or see it advertised on Facebook; I may search online for more information about it, or ask friends and family for their assessment; I could then proceed to try the product, and if I am satisfied with it, I may become a customer; I ‘ll probably visit the product’s parent company website for promotions, help and advice, maybe become a fan on Facebook or a follower on Twitter; If I’m that impressed by the product, I’ll also tell others about it. My activities as a customer are what the concept of a customer lifecycle seeks to describe. Experts have split CLM into five phases: Reaching, Acquisition, Development, Retention, and Advocacy. These are geared towards finding new customers, keeping them, and seeing them become brand advocates.

Reaching your potential customers is the first thing. Locating information about products in accessible places and forms will make the product stand a chance of attracting potential customers. Advertisements on conventional and new media are done, and data collected from this phase include clicks and information on digital impressions, subscribers picked up, success events and other indicators of a related kind.

Acquisition of information on the needs of potential customers aids businesses in developing products and services which customers will want to buy. Communicating with people on an individual basis through various channels makes this possible. Information from surveys and perception indexes should be taken from this phase, and used to fashion goods and services which appeal to potential customers.

Developing a relationship with the customer after the first purchase is the key factor in retaining customers. Finding out what their user experience has been like, having them suggest possible adjustments, fixing issues promptly and offering them appreciation packages go a long way to building trust and satisfaction.

Customer retention comes down to satisfying their needs. Possible product preferences may be determined by collecting and analysing data on the purchase history of individuals and groups.

Customers can become advocates for a product. If they have had a positive experience from it, they may share information about it with their friends and family whether physically, or through social media. This has the potential of getting the business more potential customers to consider buying and using the product.