Many small business owners dread bookkeeping. They cringe at the thought of calculating large numbers and the stress of reconciling figures on lengthy pages of financial records. But because it’s a crucial part of their business, they have to get on with it or hire someone who’s trained to crunch figures in neat columns.

But thanks to modern accounting software, we don’t have to sweat over balancing the books as much as we used to. With just a few clicks, we can dispense with the easier calculations; the more challenging ones only take minutes to handle. Businesses have shifted away from the hard task of manual accounting, and have largely embraced easy to use digital accounting tools instead.

These days, the challenge is in choosing the right type of accounting software from the myriad of alternatives. The available options aren’t all of the same quality. Some are a bit sophisticated and require fairly long training sessions periods to get a grip of; others are quite simple to use. Prices vary as well, and there could be multiple packages for any given accounting software you decide to try out.

Here, we provide some information about some of the more trusted accounting software brands. Our shortlist should help you decide which one best suits your business’ needs.

-

Sage One

Sage One is trusted by over 6 million businesses across the globe. There are a number of reasons why this is the case.

It’s an easy-to-use accounting and payroll software, which lets businesses handle a wide range of finance-related tasks. With it, you can personalize, manage and track your invoicing, keep tabs on payments, and manage cashflow and tax issues, all from your laptop or tablet.

Because Sage One is cloud-based, it lets you handle all your business accounting from wherever you are. What’s more, you can also set it up for use by multiple persons in different locations, if you wish.

There are three pricing packages available with Sage One, each representing different capability levels. The good thing is, you’ll get a lot of work done even with the least expensive packages.

-

Xero

This isn’t among the bigger names in Nigeria’s business solutions space, but it’s growing in prominence. It’s suitable for enterprises in the professional services, construction and trade, farming and agriculture, real estate and retail sectors. It does have over a million users worldwide- which partly explains its presence on this list.

With Xero, you can monitor sales, schedule purchases, track bank transactions, pay bills, and review personal expenses. Just like every typical accounting software, it gives you the liberty to handle these tasks from wherever you are.

-

QuickBook

QuickBook is another of the accounting solutions more widely in use in Nigeria. The priviledges afforded by QuickBook include accounting from remote locations (this is possible because it is cloud-based); creating and sending invoices; tracking expenses; photographing and saving receipts (the online mobile app lets you do this); generating accounting reports; and automatic backup for documents on the platform.

You can grant user access to your records for up to 25 persons. QuickBook has three paid packages, each with differing benefits. Prices start from $7:50 per month. Visit the QuickBook website to find out more.

-

SAP

SAP’s Enterprise Resource Planning (ERP) software serves some of the world’s biggest companies; but small and medium sized businesses also use it.

This software helps with cost accounting, bank statement processing, payments, automated journal entry, and financial analytics and reporting. Users can also view customer, vendor and inventory information in real time, from wherever they are.

-

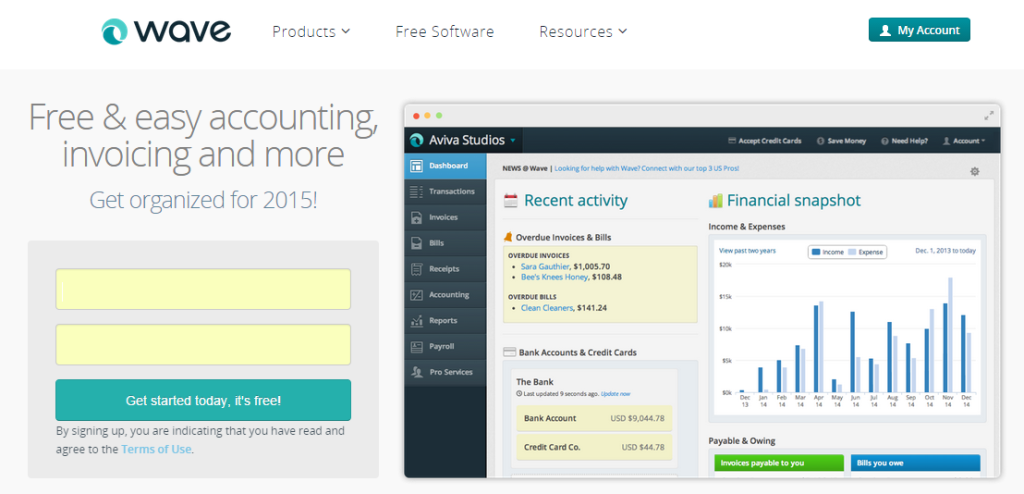

Wave

This double entry accounting tool makes it easy to generate sales and tax reports, balance sheets, and other accounting statements. You can also create customized invoices and receipts, automate payment transactions, export reports as PDF or CSV, and swiftly deal with account reconciliation.

The great thing about Wave is that it has a free-to-use package. If you want to get your accounting done quickly at little or no cost, you may try this one out.

Feature image: pinterest.com