As prices across the board continue to soar and living gets ever more expensive, there’s a lot of concern that the real value of incomes is being depleted. This concern isn’t misplaced. The National Bureau of Statistics (NBS) says that the annual inflation rate currently stands at about 21%. In other words, it has taken just a year for the naira to lose a fifth of its value.

Read more about FinTech

This isn’t the best time to hold large balances in your bank account indefinitely. If you’re doing so, you can be sure that inflation is practically shrinking your savings. Instead, you should be on the lookout for ways to protect your money from ongoing devaluation. One of the best ways to do this at the moment is to keep your funds in foreign currency, preferably on interest-bearing platforms.

Here, we’ll discuss five apps that enable you to hedge against inflation. Here they are:

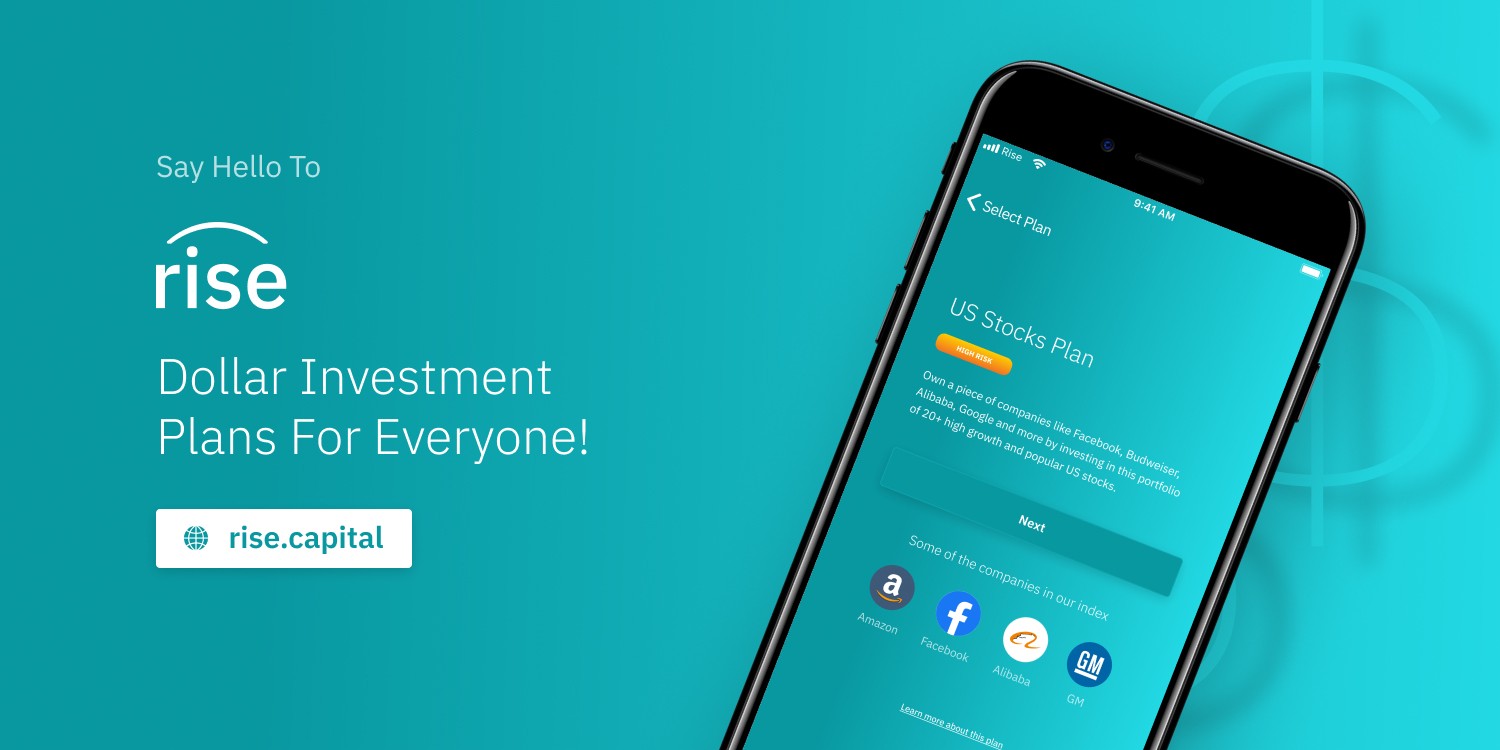

Risevest

If you’d like to funnel your cash into dollar-denominated investments that yield decent interest, you may consider checking out Risevest. This platform offers you three types of investment opportunities: fixed income, real estate, and stocks. Fixed income holdings all but guarantee an annual interest payment of 10%; the returns on real estate and stocks may vary over time.

Sign up for the Connect Nigeria daily newsletter

The great thing about Risevest is that your entire balance—including initial investments and earnings –is valued in dollars. This shields you from any devaluation that may take place with the naira. It also doesn’t cost a lot to get started with. All you need is a minimum of $10 (its naira equivalent), and you’re good to go.

Bamboo

Until fairly recently, Bamboo only offered users the chance to invest in US and Nigerian stocks (with US stock investments denominated in dollars). Although this allows users to grow their wealth significantly over the long term, the short-term volatility of the stock market means that it’s not a favourite option for risk-averse persons.

In 2022, Bamboo introduced its fixed returns product. This lets users lock away their money in dollars and earn up to 8% interest per annum on their deposits. It’s become fairly popular with persons who want the security that a stable currency guarantees without the uncertainty that’s a feature of trading and investing in stocks. The minimum you’d need to begin with Bamboo fixed returns is $10.

Bundle Africa

Bundle Africa is basically a P2P (Peer to Peer) crypto trading marketplace; a wide range of cryptocurrencies are bought and sold on it. They include popular digital assets like Bitcoin and Ethereum and coins with lesser market capitalization than these. But what’s important for our purpose here is that Bundle Africa also facilitates trades in stablecoins, which are pegged to the US dollar. Holding these stablecoins is almost as good as holding actual dollars.

What’s great about this app is that you’ll earn a 6% annual interest on BUSD, a stablecoin, if you keep it in a ‘vault’ on the platform. However, early withdrawals are not allowed (besides payment dates).

Register to attend the CN Business Mixer

Cowrywise

Cowrywise is a wealth management app that offers investments in a variety of mutual funds. While these are primarily naira denominated, there is the chance to buy into dollar (Eurobond) mutual funds. These plans yield returns in at least three ways: dividends (periodic payouts), capital appreciation (if the unit price of the fund increases), and currency appreciation (a change in the value of the naira per dollar).

You can begin investing in Cowrywise’s dollar mutual funds for the naira equivalent of $10. It’s also easy to get started with. All that’s required is to download the app, sign up and set up a free account, create a new investment, and invest in your preferred dollar mutual fund.

PiggyVest

One of Nigeria’s most popular savings and investment platforms, PiggVest is used by millions of people, many of whom keep their funds in naira to enjoy the competitive interest rates that the app guarantees them.

But PiggyVest is also known for its Flex Dollar product, which is a dollar savings account. It allows users to save in dollars and receive interest payments of up to 7% per annum, paid out every month. You can access this service after signing up on their app or website.

Featured Image Source: The Guardian NG

Got a suggestion? Contact us: [email protected]