Personal finance is a term that involves managing your money as well as saving and investing. It includes budgeting, banking, insurance, mortgages, investments, retirement planning, tax and estate planning.

Read more about FinTech

Personal finance involves meeting individual financial goals, whether short-term financial needs, planning for retirement, or saving for your child’s college education. It all depends on your income, expenses, living requirements, individual goals and desires, and coming up with a plan to fulfil these needs within your financial constraints.

To make the most of your income and savings, it’s important to become financially literate, so you can make smart decisions.

Personal finance apps can connect with your personal and corporate bank accounts and help you keep up with your spending. In addition, personal finance apps can help you identify areas that you’ve been spending, track impending bill payments and keep up with your credit score and investment portfolio. The best personal finance apps provide a variety of features (email reminders, bill due dates, track subscriptions, shared wallets, etc.) for managing your overall finances.

Some Of The Personal Finance Apps Include

PiggyVest App

PiggyVest is a simple saving idea of a piggybank as it presents you with the opportunity to use the ‘piggybank’ feature to reach personal savings goals more quickly. You can use the Target Savings feature which helps you save for multiple goals like holidays, fees, and special events. The app has added features such as Safe Lock, which secures your funds, and helps you avoid impulsive spendings.

There is also the opportunity to partake in investments by investing in little bits that one can afford. This app prides itself as the first online savings and investment app in West Africa, offering customers direct investment opportunities.

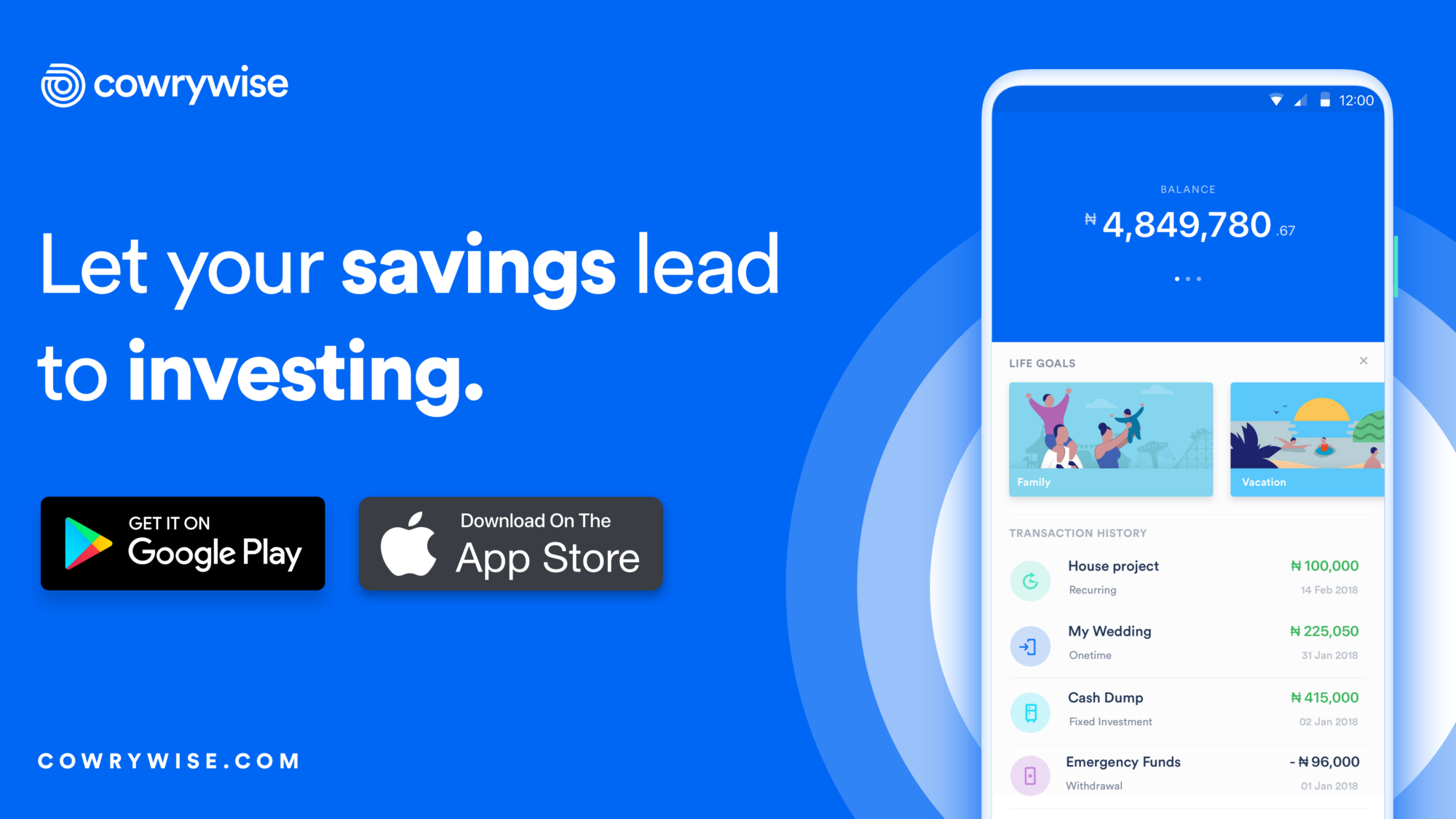

Cowrywise Money-Saving App

Cowrywise is another top personal finance app launched in 2017. This app can help you activate the autosave feature with a specified amount periodically or you can use the one time savings feature to fund your account. Depending on what works for you, at least you are sure that your money is secure.

Once you put in your desired savings amount, your savings are locked for a minimum duration of three months with no maximum time limit. Interest is paid on your savings every day at midnight.

Personal Capital App

This app is a personal finance app that makes sure that your money is safe when you use its money-saving app. This particular investment app helps to limit your spending habits, ensuring that you save more and be very intentional about your financial decisions.

This self-help tool offers two primary functionalities; a free personal money manager and a paid investment management service. The free function allows you to keep an eye on your income, assets, expenses, and investments from a single portal, get investment advice on how to optimize and make more money, meanwhile the paid version, which is also known as the Wealth Management program offers more personalized portfolio management.

MINT App

This is one of the most popular personal finance apps of all time. This app has been known for its easy-to-use programs and friendly user interface because it gives a more graphical display, which helps users navigate the app seamlessly.

This personal finance management app allows users to monitor their bank, credit card, investment, loan balances, and a number of other transactions through a single user interface. One of the benefits of this app is that it automatically syncs with your financial institutions to track user bills and gives constant alerts to ensure you keep up with payments.

Based on monetary data and transactions, its features allow users to create categories, track budgets, and set financial goals. It encourages savings by recommending credit card deals and insurance.

Featured Image Source: Reuters

Got a suggestion? Contact us: [email protected]