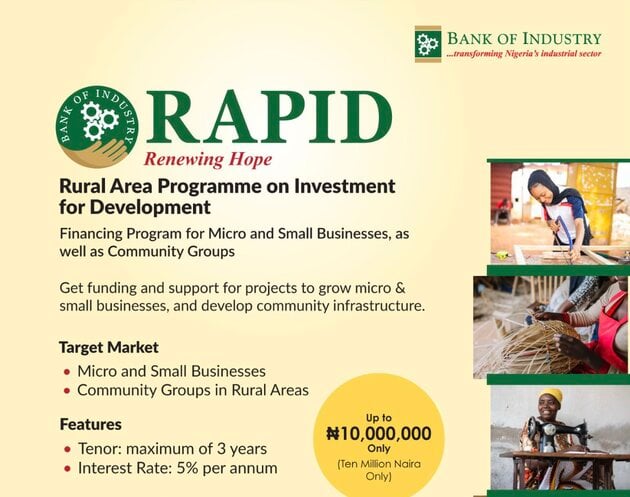

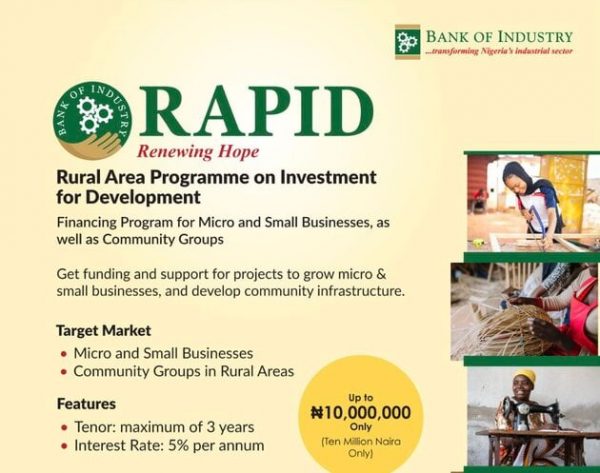

Applications are currently being accepted for the 2024 Bank of Industry (BOI) Rural Area Program On Investment for Development (RAPID). This initiative aims to support communities in rural and economically disadvantaged areas by facilitating the development of enterprises that can create jobs, enhance living standards, foster national growth, and address issues of insecurity stemming from youth unrest.

Read more about Opportunities

The Bank of Industry (BOI)-RAPID program is focused on providing financial assistance to nano, micro, and small-scale businesses in rural settings. Beyond financial aid, beneficiaries will receive access to business advisory services and training programs geared towards ensuring the viability, expansion, and sustainability of their businesses.

Sign up for the Connect Nigeria daily newsletter

Target Audience:

- Micro and Small Businesses

- Community Groups in Rural Areas

Key Features:

- Loan Duration: Up to 3 years

- Interest Rate: Fixed at 5% per annum

Register to attend the CN Business Mixer

Eligibility Requirements

- Completed Application Form

- Business Plan

- Valid Means of Identification

- Bank Verification Number (BVN) and National Identification Number (NIN)

- Proof of Residential Address

- Completed Guarantor Forms

The application window will remain open until May 29, 2024. Interested parties can submit their applications HERE.

Featured Image Source: Opportunities for Africans

Got a suggestion? Contact us: [email protected]