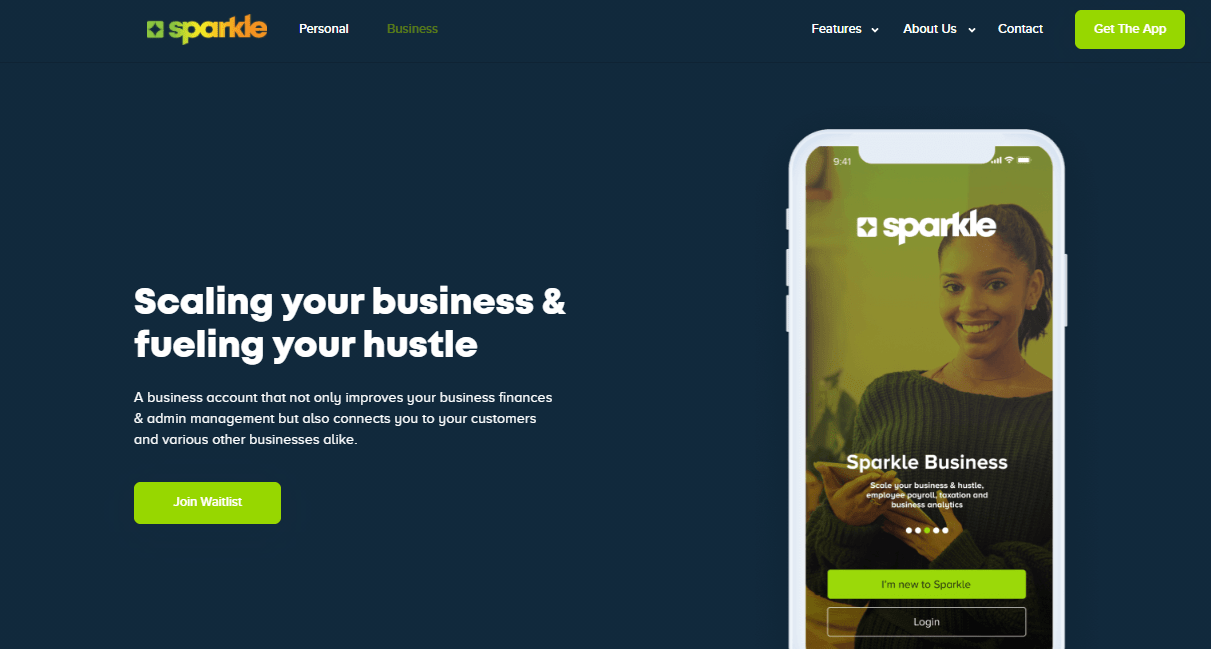

Since Sparkle launched in the fourth quarter of 2019, it has been somewhat operating below the radar while offering a personal account that lets individuals save money, manage personal finances, and send payment requests to other customers with just a link.

Read more about Tech

Over this period, Sparkle reports that it has processed $16m in transactions with more than 20,000 customers with its beta test. The startup company is now going a step further in the financial solutions journey by offering a suite of digital payments and business management services for small and medium scale businesses in Nigeria.

Uzoma Dozie, the founder and CEO who was the ex-Managing Director of the Diamond Bank which merged with Access Bank said that the plan for the new product on the shelves of Sparkle is to provide

“a one-stop-shop, to help individuals to launch their businesses digitally while meeting existing SMEs’ pain points, and allowing them to pivot to the next level of success.”

The first-time startup founder is leveraging no doubt on his years of experience offering such products in the SME traditional banking sector.

According to the company, Sparkle for SME business will have 4 main components; payment gateway service; tax advisory; inventory and invoice management; payroll and employee management.

With these combination offers, Sparkle is taking digital banking a level higher than Kuda bank took innovations in the subdomain of modern banking.

Sign up to the Connect Nigeria daily newsletter

The new product rollout is designed with small business owners familiar with digital platforms in mind. It will help entrepreneurs control payment requests, manage single and bulk payments, track business performance, calculate tax filings and administer employee benefits. If well managed, operating in the SME niche which drives the bulk of the nation’s economy will open up the company to unlimited opportunities.

Yet, the team at Sparkle insists that they are more than a digital bank or a mobile app. The “We are not a bank, we are a tribe,” slogan emblazoned on their landing page and to be at the intersection of individuals’/small businesses’ finance and lifestyle aspirations screams what their ethos is.

The startup’s general offering will be relying heavily on analysing data extracted from user behaviour and broader industry trends to make tailor-made recommendations for each unique user.

New users are required to supply a Tax Identification Number (TIN) and an email address connected to the number in other to enjoy the new release.

Sparkle hopes to launch its complementary full-fledged banking-as-a-service platform, which they describe as their most important feature, soon; after the business-focused product in their kitty.

Fingers remain crossed if Sparkle or other competing interests can really deliver on a scaled digital banking/banking-as-a-service promise.

Featured Image Source: Aptantech

Got a suggestion? Contact us: [email protected]