It is no news that the future of banking will likely be at the fastest evolutionary pace than we have seen, this is because, the banking sector is moving faster than ever before as traditional banking organizations are moving away from existing business models.

Read more about Fin Tech

The emergence of new financial competitors in the market, especially Fintechs means that the future of the financial sector, especially banking, will not be just a continuation of the past because in few years, new technologies and innovations will transform the banking industry, thereby offering vast opportunities as well as challenges for various financial institutions.

Over the past few years, new competitors who emerged in the banking sector have been introducing various financial services and delivering products that are highly personalized and delivered with speed and simplicity. Because of this, consumers have diversified the financial institutions they work with, thereby building their own open banking style of portfolio of savings, borrowing, payments and investment apps to meet their needs.

This has been the situation for some years now, however, there is so much to expect in years to come, as the banking sector with the use of Fintech, will grow faster beyond what we can experience in this present day.

Some of the predictions on technology in the banking sector include:

Artificial Intelligence will thrive Extensively

The benefits of Artificial Intelligence cannot be overemphasized as most banks have already seen and experienced the positive impact in the areas of compliance, back-office operations, customer experience, product delivery, and risk management.

However, it is strongly believed that the use of Artificial Intelligence will scale significantly in areas like precision marketing and even talent management.

Digital Account Opening

Soon, no one will necessarily have to walk into a physical bank to open an account as majority of the banks are expected to add a new or replacement consumer digital account opening system as soon as possible.

Most banks have already deployed a new consumer digital account opening system in the past few years to aid account opening, and it is believed that in few years to come, there would be massive use of the digital account opening system that grants you the opportunity to open an account from the comfort of your homes.

Sign up to the Connect Nigeria Daily Newsletter

Massive Change of Business Models

Presently, the banking sector is faced with a compliance management and cost associated challenge that is slowly compelling most banks to change or modify the way they operate.

There are various issues that exert pressure on conventional sources of banking profitability, some of these issues include the constant increasing cost of capital coupled with low interest rates, reduced proprietary trading, and decreasing return on equity.

For this reason, some banks have understood their key strengths and weaknesses and then choose a business model that best intensifies their core competencies.

Knowing and adopting a suitable business model will soon be the order of the day, as it would give bankers the ability to enforce both strategic and tactical decisions to make the most of their platform.

Continuous Adoption of the Blockchain Technology

Presently, the Blockchain technology allows banks to reduce unwarranted bureaucracy, improve security, and perform faster transactions at considerably lower costs, in addition, banks derive lots of profit from using Blockchain-based crypto currencies.

Undoubtedly, it is predicted that banks will continue to adopt this technology to improve efficiency, security, and cost-effectiveness, throughout the entire range of financial services.

Optimization of Digital-Human Interplay

Majority of banks and financial institutions have prepared themselves to tap into the latest opportunities of this digital world, and they are starting to find their way around the complex challenges of culture shifts and new skill sets.

Therefore, in few years to come, financial institutions will outsource talents from outside the banking industry to become more responsive and varied in a world of blurring and changing industry boundaries.

It is fair enough to say the wave of technology will blow massively across the banking sectors in years to come, as these innovations that come with it work to serve the customers better and still ensure that these banking sectors make profit as well.

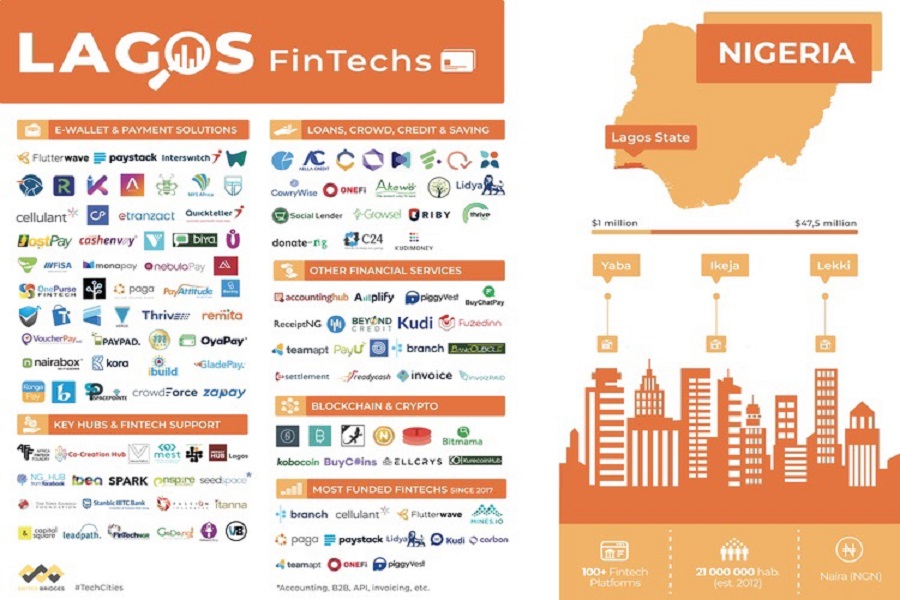

Featured image: Nigeria Galleria

Did you find this article useful? Contact us: [email protected]