Billboxx, a Nigerian startup that’s helping SMEs solve their cash flow problems, has secured $1.6 million in its pre-seed funding round. This was announced on Wednesday on multiple platforms. The company intends to deploy the funds to expansion efforts and add to its array of solutions.

Read more about FinTech

The round, which is made up of debt and equity, was led by Norrsken Accelerator, with participation from Kaleo Ventures, 54 Collective, P2Vest, and Afrinovation Ventures.

Billboxx provides invoice financing to small and medium-sized businesses. This helps them bridge cash flow gaps that may exist before clients pay for products or services. Cash flow troubles are a major concern for SMEs and are a leading cause of business failure in countries like Nigeria.

Payments from Billboxx to user SMEs are made only when their enterprise clients approve. The startup collects a 5% fee for invoice financing and a 1.5% transaction fee for payments made through its platform. It claims that, thus far, it has had no defaults.

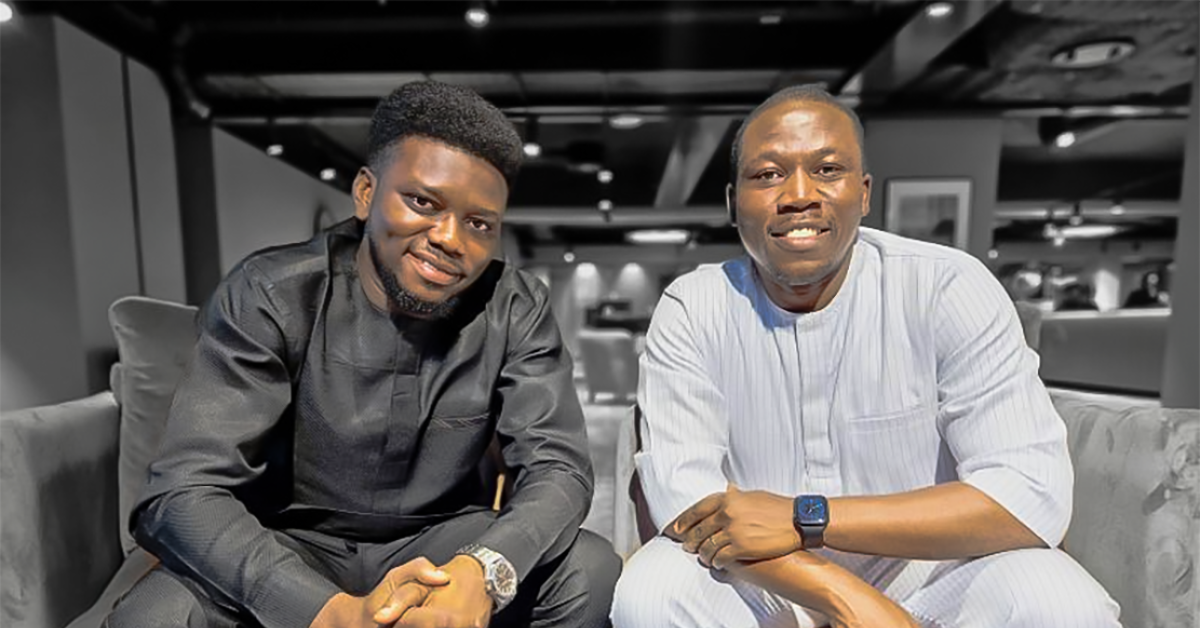

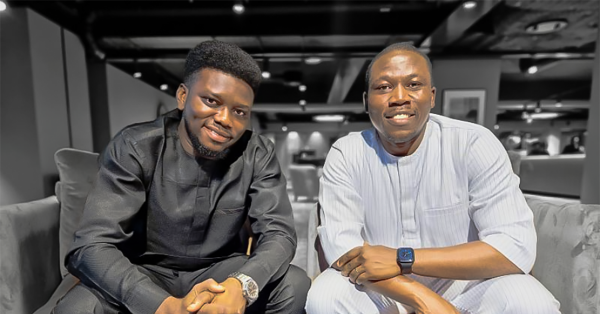

The co-founders at Billboxx—Justus Obaoye and Abdulazzez Ogunjobi –established the startup in 2023. According to their team, they have facilitated over $4 million in invoice payments since the launch of their Minimum Viable Product (MVP) a year and a half ago. Thanks to its integrations and partnerships with banks and payment gateways, Billboxx is able to support payments to businesses via cards, bank transfers, and other forms of financing.

Sign up for the Connect Nigeria daily newsletter

Obaoye and Ogunjobi have prior experience as founders, having previously co-founded two startups, Charistouch and Fixit45. They have also worked with several large companies, including Uber and Schlumberger.

Investors say they have supported Billboxx because of the strength of its leadership and the size of the market it’s catering to. In the words of Bongani Sithole, CEO of 54 Collective (one of the backers in Billboxx’s pre-seed funding round):

“We invested in the company due to the large market size of the opportunity, impressive early traction gained from strong early partnerships with notable large corporates and startups, as well as the solid tech product the team has developed.”

Register to attend the CN Business Mixer

Propelled by the funding it’s secured, Billboxx plans to expand elsewhere in Africa and introduce a feature that lets SMEs plug into new opportunities within the corporate space.

Got a suggestion? Contact us: [email protected]