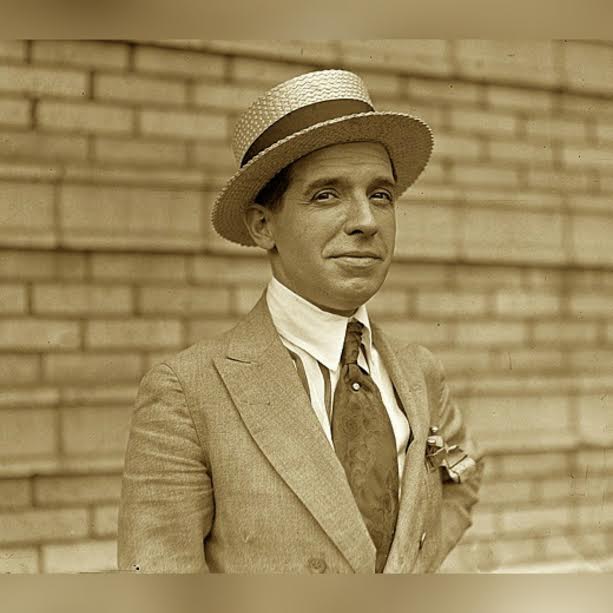

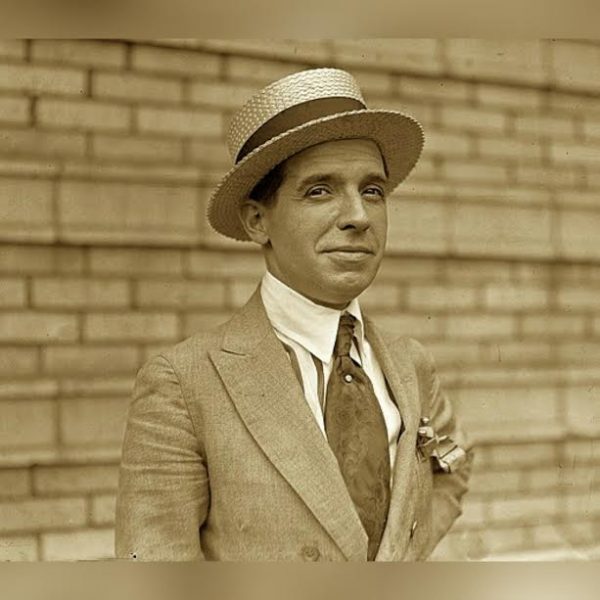

Charles Ponzi was a criminal whose name lives on in the term “Ponzi scheme” which refers to a fraudulent investment operation where the operator pays returns to investors from new capital received from new investors, as opposed to paying returns from profit earned through legitimate sources – all the while lining his own pockets.

In other words, rather than invest money received so as to make profit which can then be divided amongst investors, Ponzi scheme operators pass money from hand to hand while enriching themselves. The early investors are paid using money from later investors; robbing Peter to pay Paul.

Of course, the problem is obvious: Ponzi schemes require a continual stream of investment to keep running, so when investment slows down or stops, the scheme collapses and the new investors lose their money as there’s nobody else’s money to give to them. Sometimes instead of merely collapsing, it crashes because people hear about the problem and start hurrying to pull out their money.

Ponzi schemes don’t always start off as such. Sometimes they start as legitimate operations and then, as a result of unexpected loss of money or failure of the business to progress as planned, they degenerate into Ponzi schemes. This happens when the operators choose to fabricate false returns and produce fraudulent audit reports, instead of simply admitting their failure to meet expectations.

One example is MMM, which is gaining more and more popularity in Nigeria by the hour. МММ was a Russian company that perpetrated one of the world’s largest Ponzi schemes of all time, in the 1990s. It was established in 1989 by Sergei Mavrodi, his brother Vyacheslav Mavrodi, and Olga Melnikova. The name of the company was taken from the first letters of the three founders’ surnames.

Sometimes instead of merely collapsing, it crashes because people hear about the problem and start hurrying to pull out their money.

Initially, the company imported computers and office equipment, but after a series of difficulties, its successful Ponzi scheme was created in 1994. It crashed in the same year and was officially closed in Russia in 1997, only to show up in other countries, most recently Zimbabwe, South Africa and Nigeria.

So who was Charles Ponzi, and what was the nature of his scheme which has inspired so many others over the years?

1. He was born Carlo Pietro Giovanni Guglielmo Tebaldo Ponzi in Lugo, Italy, in 1882.

2. He arrived in the U.S. from Italy in November 1903, quickly learning English and doing a few odd jobs.

3. In 1907, a new bank, Banco Zarossi, was opened in Montreal by Luigi “Louis” Zarossi to cater to Italian immigrants who were entering the US in droves at that time. The charming and cheerful Charles Ponzi, who was by now fluent in English, French and Italian, relocated to Canada and got a job at the bank as an assistant teller, eventually rising to the position of bank manager.

4. Unfortunately the bank ran into serious trouble, and Charles Ponzi soon realized his boss was funding the interest payments not through profit on investments, but by using money deposited in newly opened accounts. This was where Ponzi first saw the concept at work. Soon, the bank failed, Luigi Zarossi took off to Mexico with a large portion of the bank’s money, and Ponzi was out of work and broke.

5. Ponzi was arrested in Canada for forging a signature and writing himself a cheque. He had walked into an office, found nobody there, and picked up a chequebook he saw there. Were it not for his huge expenditures just after the cheque was cashed which alerted police, he may never have been caught. He was released from prison in 1911.

6. After his release, he returned to the US but was soon arrested again for trying to smuggle in Italian immigrants. Upon his release, he worked for various people, doing different jobs including nursing. Eventually, he started his own business, a completely legitimate stamp arbitrage business which made him a lot of money.

7. Sadly, Ponzi’s greed got the better of him and he set up his own stock company to raise more capital that would enable him rake in more profit. This company, “Securities Exchange Company,” promised to double investments in 3 months. The business grew like crazy with people mortgaging their homes and investing their life savings.

8. Unfortunately for Ponzi, he had not done his due diligence. He was already in too deep when he realised that his business idea could not work on a large scale the way it had worked on a small scale, due to logistics. Instead of actually figuring out how to make profit using the capital he raised, Ponzi simply resorted to paying investors with funds from subsequent investors, while also helping himself to the funds.

9. Charles Ponzi lived a luxurious lifestyle, buying a mansion, the finest cars, and things like gold-handled canes and expensive cigars in diamond holders. At his peak, he was reported to have been making $250, 000 a day.

10. The scheme came crashing down in 1920, wiping out its investors and bringing down five banks. When regulators found out he had not been dealing in postal stamps as he claimed (and as was actually his original intention) Charles Ponzi was arrested, tried and eventually spent a total of 14 years in prison.

He was released in 1934 and immediately deported to Italy. He tried a few schemes which never took off, and occasionally worked as a translator. He spent the rest of his life in poverty and after severe health struggles which culminated in partial paralysis, he died in 1949 in a charity hospital in Rio de Janeiro, Brazil.