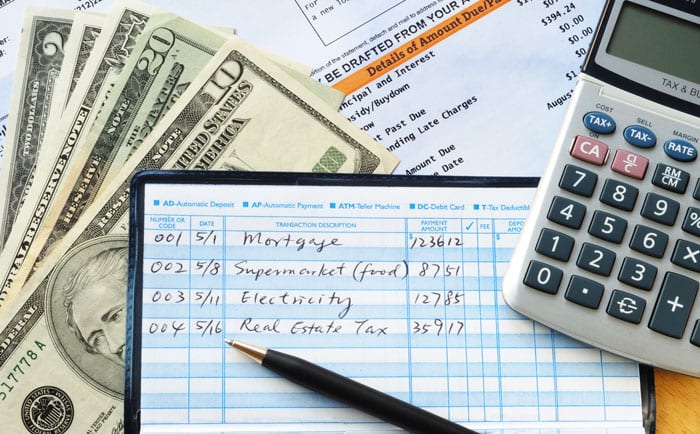

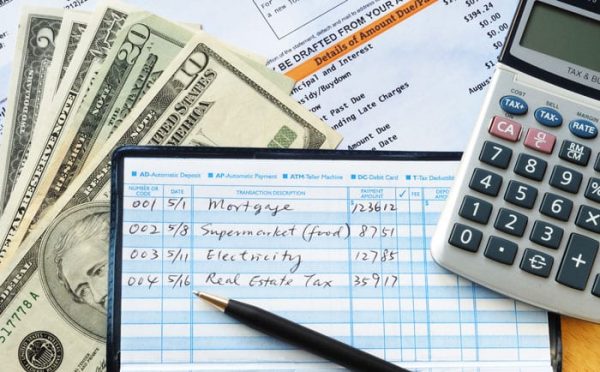

Living on a small salary in Nigeria is not easy. Prices are rising every day. Food, transport, rent — everything dey cost. But even with a small income, you can still live well if you plan well. That’s where a sustainable monthly budget comes in.

Read more about Finance

A sustainable monthly budget is simply a money plan that works for you long-term — one you can follow without stress every month. This guide will show you how to create your own sustainable monthly budget, even if your salary is small. Let’s go!

-

Know Exactly How Much You Earn

Before you can plan your money, you must know what you earn every month. Don’t guess. Be honest. Is your salary ₦50,000? ₦80,000? Do you get extra income from a side hustle, business, or freelance jobs? Write everything down.

Example:

- Salary: ₦60,000

- Hairdressing on weekends: ₦10,000

- Total Monthly Income = ₦70,000

That’s your starting point.

-

Track Where Your Money Goes

The next step is to check how you currently spend your money. For one full month, write down every single thing you spend money on — even small ₦1,000 suya.

Break your spending into categories:

- Food & Cooking Gas

- Transport

- Rent (or Savings for rent)

- Data/Call

- Offering/Tithes

- Family Support

- Miscellaneous (unexpected stuff)

This will shock you. You may be spending more than you think on things that don’t matter.

-

Set Clear Priorities

You must learn to put important things first. When money is small, you can’t buy everything. A sustainable monthly budget helps you choose wisely.

Divide your expenses into:

Needs (must-haves) — e.g., food, transport, rent. Wants (nice-to-have) — e.g., new clothes, eating out, latest phone. If your salary is low, try to focus 80% of your spending on needs and only 20% on wants.

For example, from ₦70,000:

- Needs = ₦56,000

- Wants = ₦14,000

Wants can wait. Needs come first.

-

Use the 50/30/20 Rule (But Adjust It!)

The 50/30/20 rule is a popular method, but for low-income individuals, you may need to adjust it. Here’s a modified Nigerian version:

- 60% for Needs (rent, food, transport)

- 25% for Savings & Debts (emergency fund, loan repayment)

- 15% for Wants (Netflix, small enjoyment)

From ₦60,000 monthly:

- Needs = ₦36,000

- Savings = ₦15,000

- Wants = ₦9,000

Even if you can’t save ₦15,000, just try. Save what you can, even if it’s ₦3,000.

-

Start Small Savings — No Matter How Small

Saving is hard when the salary is low, but it’s not impossible. Instead of waiting to save big, start with what you can.

Options:

- Use piggybank, Cowrywise, or Kuda savings features.

- Keep a money box at home (kolo).

- Save daily or weekly instead of monthly.

Example:

- Save ₦500 every week.

- That’s ₦2,000 in a month.

- In 6 months, you have ₦12,000.

Savings give you peace of mind. It protects you from unexpected problems like illness, phone repair, or sudden job loss.

-

Cut Down Waste

Ask yourself honestly: “What can I cut down?”

Some ideas:

- Cook more at home instead of buying food.

- Use cheaper data plans or Wi-Fi sharing.

- Walk short distances instead of taking a bike/keke.

- Buy in bulk with friends to save costs (e.g., rice, garri, detergent).

- Share rent with roommates or move to a cheaper place if possible.

Little changes add up. That’s how to keep your sustainable monthly budget working.

-

Use Budgeting Tools or Notebooks

If you have a smartphone, you can download free budget apps like:

- Spending Tracker

- Money Manager

- Mint (for advanced users)

But if you prefer pen and paper, no wahala. Use a small notebook. Divide it into Income, Expenses, and Savings. Update it every week. Make it fun. Make it yours.

-

Plan for Big Expenses Monthly

Don’t wait till December to start saving for Christmas. Don’t wait till rent is due before you start planning.

- Break your big expenses into small monthly savings:

- Rent = ₦120,000 per year → Save ₦10,000/month

- School fees = ₦60,000/year → Save ₦5,000/month

Planning ahead removes stress.

-

Avoid Unnecessary Debts

Borrowing money for food or clothes is dangerous. It keeps you stuck. If you must borrow, make sure it’s for something important and you can pay it back quickly. Live within your means. It’s not pride, it’s wisdom.

-

Review Your Budget Monthly

Things change. Prices change. You may earn more or less next month. Always review your sustainable monthly budget every 30 days. See what worked and what didn’t.

Ask yourself:

- Did I save as planned?

- What expenses surprised me?

- Where can I improve?

Final Thoughts

Even if your salary is small, you can still live in peace if you have a sustainable monthly budget. It gives you control over your money and reduces stress. Start small. Be patient. Be consistent. Over time, you’ll see results. So, are you ready to take charge of your money this month?

Featured Image Source: In Charge Debt Solutions

Got something you want to read about on our platform? Contact us: [email protected]