The general awareness of insurance in Africa has been bland for years, along with its penetration rate, except in South Africa. In line with a Mckinsey survey in 2018, Africa’s insurance market was at a 3% penetration rate; with South Africa excluded, it was just 1.12%. Only 1.9% of the adult population had one form of insurance policy in Nigeria as of 2018.

Read more about Insurance

African countries especially Nigeria are yet to catch up with social security and insurance programs commonly used in the Western world, where the government provides health insurance and unemployment aid to citizens.

Although, we have pension/gratuity in Nigeria slated for those who retired from civil service, however, it’s hardly paid. There are other reasons insurance has failed to rise in Africa’s vast technological market. First, traditional insurance companies in Nigeria have built their businesses on compulsory insurance for enterprise customers in oil and gas, energy, and property. Most insurance business economics is suited for large and not small transactions which isn’t necessarily a bad thing, but this way, insurance products can’t get to the mass market. There’s another reason for this low insurance adoption; the preference for instant satisfaction over long-term benefits. In essence, people prefer to invest in positive rather than adverse outcomes.

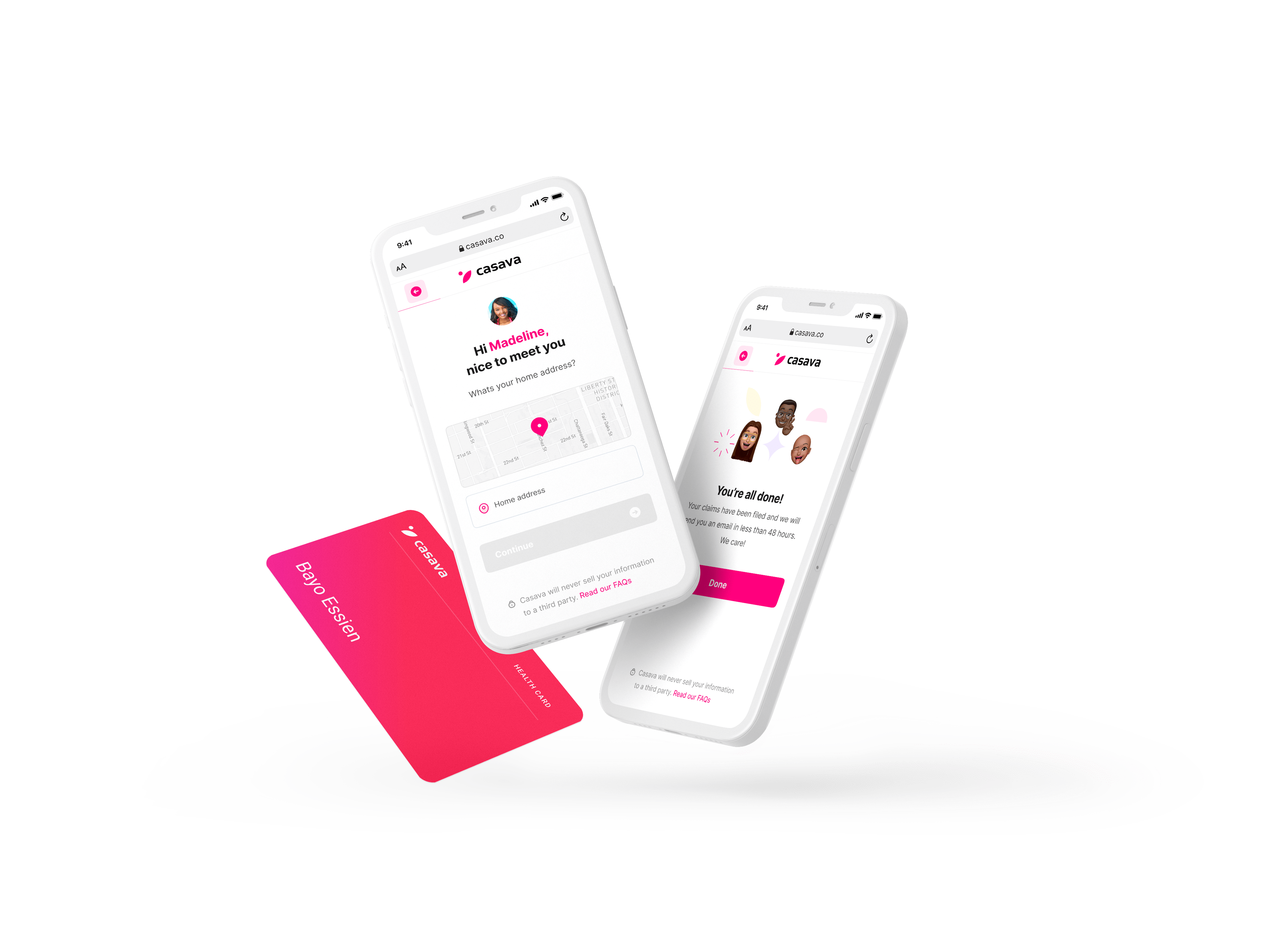

The idea that insurance companies priority in Nigeria are on the more wealthy and huge investment risk zone makes them ignore everyday people who might want to insure their lives and properties against risk. Despite this dire situation, many startups are springing up in Nigeria to widen the insurance range across the country. An example of such a startup is cassava, a hundred percent digital insurance company. The founder of casava, Bode Pedro, announced that they have raised a $4 million pre-seed fund to take advantage of Nigeria’s untapped insurance market. The funding will also support more product launches from life and travel insurance to home and smartphone insurance, apart from health and job loss it’s currently rendering services on.

The fund will also be used for customer acquisition, growth, and developing cassava’s product and technology package. The InsurTech company plans to work with FinTech and digital partners to ingrain insurance products into their offerings. This way, it hopes to gain access to over 500,000 financial service agents to reach millions of uninsured customers nationwide and keep them out of poverty.

The round was led by Berlin-based Target Global, with foreign Venture Capitals and Angel Investors such as Entrée Capital, Oliver Jung, Tom Blomfield, Ed Robinson, and Brandon Krieg. The local investors involved in the rounds are all founders and they include Uche Pedro, Babs Ogundeyi, Musty Mustapha, Shola Akinlade, Olugbenga Agboola, Honey Ogundeyi, Tosin Eniolorunda , and Opeyemi Awoyemi.

Sign up to the Connect Nigeria daily newsletter

When customers subscribe to Casava’s insurance products directly via the website, mobile app, or WhatsApp, they are given a month-free trial with an option to opt-out should they not like the service. But in all, Casava aims to provide subscribers with value-added services such as executive coaching, telemedicine, and job services.

The digital insurance platform currently provides cover for health and job loss. Insurance around job loss although very uncommon but relatable in Nigeria. There is a market for it since 20% of workers in Nigeria lost their jobs because of the pandemic. The country’s high rate of unemployment places the insurers at risk but Casava has found a way to make it work with its Income Protection product.

According to the company, subscribers can insure their income from $1 (500 naira) monthly, and get paid monthly for six months if they lose their job, become sick, or disabled. Subscribers can also use its Health Insurance product and access more than 1,000 doctors on telemedicine and 900 hospitals across Nigeria. There’s also HealthCash which lets users get reimbursed when they visit the hospital for specific periods, all for 250 Naira ($0.5) to 300 Naira ($0.6) a month. Casava works with reinsurance partners who guarantee a refund when claims are paid as a licensed microinsurance underwriter. That’s how it makes revenue asides from profit off subscription fees. The company says it already has more than 66,000 customers, with $16 million in insurance coverage.

Insurance is about unfavorable developments, which Nigerians and human beings, in general, don’t like to think about. Even when they do, they clear it in their mind. But the negative situations are a core part of life and If one prepares for it, the less it will hurt when it happens. Nigerians need to s subscribe to cassava to get affordable protection from risks and adversities.

Featured Image Source: Disrupt Africa

Got a suggestion? Contact us: [email protected]