There are more ways to save these days than we’ve ever had. Besides the traditional bank accounts, we have a multitude of digital platforms that allow you to put some money away for the future.

Read more about FinTech

These platforms—available as downloadable apps –offer impressive interest on money saved with them, typically more than you’ll get from your regular bank.

But savings apps don’t all provide you with the same quality of service. Some are top-tier, with decent products and responsive customer service. Others are less appealing, barely garnering any good reviews.

Here we’ll talk about the best saving apps in Nigeria, and what makes them the more desirable of the many available.

PiggyVest

PiggyVest is easily the largest digital savings platform in Nigeria, with over ₦1 billion saved on it every month. It enables users to set aside portions of their income periodically through automated deductions, and attain set savings targets.

There are multiple savings plans available with it. The Piggybank Wallet allows users to save on a daily, weekly, or monthly basis. Another, Target Savings, lets users save for specific goals, such as rent, school fees, and travel. SafeLock gives you the chance to hold money for longer periods and earn competitive interest on it.

There’s also the Flex Naira, a flexible savings box for emergency funds, and the Flex Dollar, which lets you save money in foreign currency.

Cowrywise

Cowrywise is a savings and investment app with multiple plans that cater to the need of various user categories.

First, there’s Regular Savings, a product that enables savings for a minimum of three months. Then there’s Life Goals, a long-term savings tool. Savings Circle makes it possible to save with a group of other people. All three of these attract healthy interest payments.

A fourth product, the Halal Savings, provides interest-free savings without automation, for people who do not want to receive interest on the money they put away.

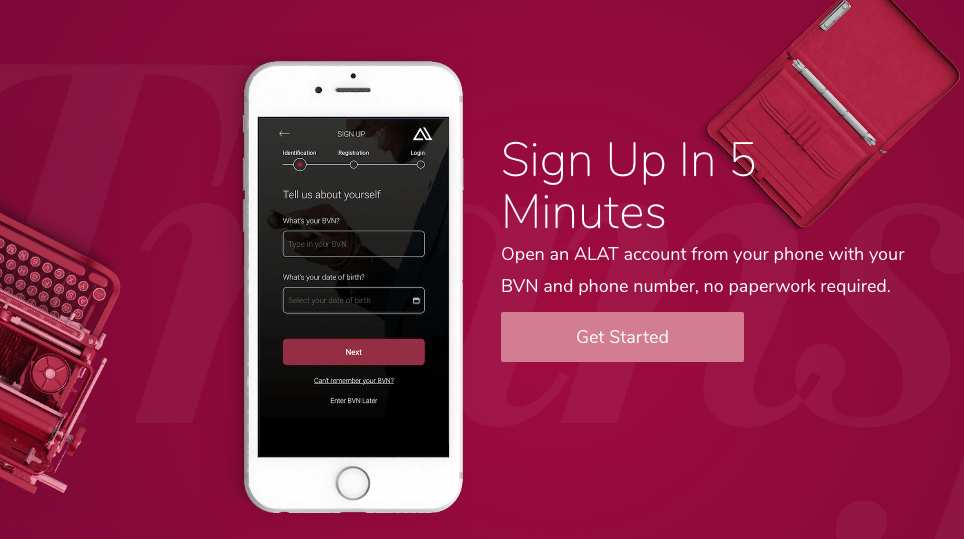

ALAT By Wema

ALAT says it’s Nigeria’s first fully digital bank. Apart from the regular banking transactions that it enables, it offers a Savings Goals service, for which users of the app can sign up.

Individuals can save up for specific things, and set up a budget there too. They can even create multiple savings plans. These are either flexible (Flexi) or fixed plans. Things like amount to be saved, savings frequency (daily, weekly or monthly), and start and target dates can be set at the start of the plan.

ALAT available fr download on the Google Play Store and the iOS App Store.

Sign up to the Connect Nigeria daily newsletter

Carbon

Carbon is primarily a loan app, and one of the better known in this category. However, there’s a savings feature that lets users save for a goal they choose.

The savings categories available from Carbon are the Cash Vault, a fixed deposit account that earns users up to 11% returns for amounts above ₦50,000; the Goals, for daily, weekly or monthly targets, which earn as much as 9.5%; and FlexSave, a one-time plan that yields 9% interest.

Carbon is registered with the CBN and insured by the NDIC, so savings and investments on the platform are safe.

KoloPay

The KoloPay team describes their product as “a mobile piggybank”. They promise up to 10% interest on savings made with them.

Persons interested in using the platform can begin by signing up with it. After doing this, they may set up a savings goal, and begin saving on the KoloPay app.

Users can enable automated deductions from their bank accounts, and save on a daily, weekly, or monthly basis. They can also set multiple goals, and invite people to contribute to crowd-fund (contribute as a group) toward your goal.

SumoTrust

The attractiveness of SumoTrust’s offerings is pegged on two things: high returns, and the absence of hidden fees.

SumoTrust has four savings categories. The Main Savings promises up to 10% interest on amounts saved on it, with withdrawals limited to fixed dates. The Fixed Savings is locked for the duration of the user’s investment and yields up to 15% returns. Missions’ Savings are for set targets. And there’s the Kick Account, which is practically a no-interest wallet.

You can save as little as ₦100 per day on SumoTrust.

Kuda

Kuda is one of the most widely used digital banks in Nigeria. As such, its features aren’t limited to savings. It comes with a debit card, free transfers, and a budgeting feature that lets you track savings and expenditure.

Savings on Kuda comes without bank charges and can be done daily, weekly, or monthly. The interest on funds kept with it may touch 15% per annum.

Kuda is registered with the CBN and deposits are insured by the NDIC.

Final Words

If you’ve been looking for the best ways to save money, you have seven options to choose from. Be sure to do your due diligence before signing up with any of them.

Featured Image Source: Nairametrics

Got a suggestion? Contact us: [email protected]