Thanks to digital technology, you can invest in successful businesses from wherever you are. All you need is a smartphone, access to the internet, and mobile apps that bring investment opportunities to your fingertips.

There are so many of these apps that it’s difficult to tell which ones are worth your while. You can be sure that there are brilliant options—and subpar ones too. How do you identify the best of the bunch?

Read more about Mobile Apps

Let’s save you the stress of sifting through the whole lot. Here are the ten best investment apps in Nigeria right now, each offering exciting opportunities to grow your wealth.

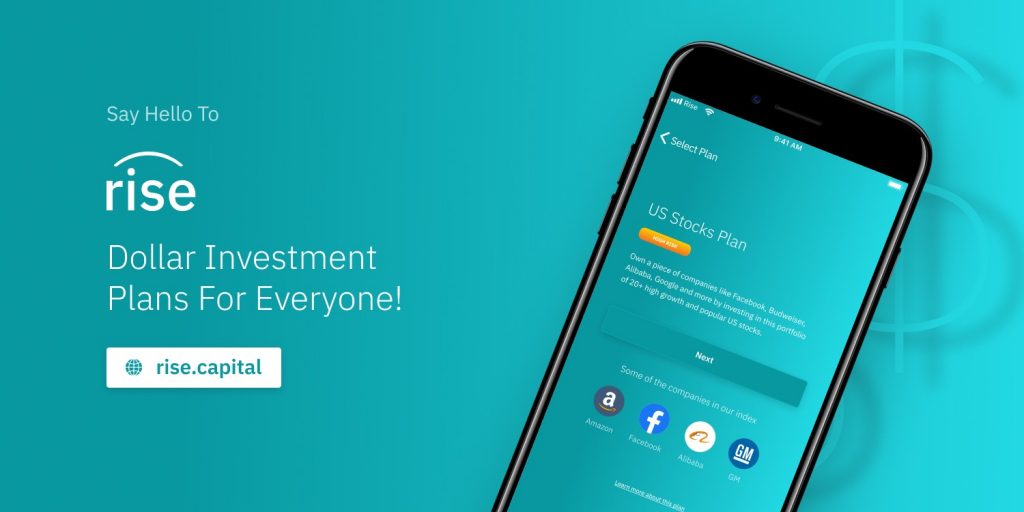

Rise Vest

The Rise app has one big selling point—it gives users access to dollar-denominated investments. With it, you can buy Federal Government Eurobonds, get a piece of the US real estate market, and invest in expert selections of high performing American stocks.

The good thing is, you can get started on Rise with as little as $10 (you can fund your Rise wallet from both naira and dollar bank accounts).

Read more about Rise here.

Bamboo

Another app that gives you access to the US stock market. But unlike Rise, you get to choose the stocks you want by yourself. You are free to choose shares from over 3,000 US companies and either trade them daily or hold them for the long term.

You can begin your investment journey with Bamboo for as little as ₦15,000. There’s more on Bamboo here.

Cowrywise

The Cowrywise app offers multiple savings and investment plans, with returns to boot. Interest on savings could reach 15% per annum.

The investment options available on the app include Federal Government Eurobonds (dollar-denominated) and a range of mutual funds, ranked according to perceived risk levels. You can get going on it with a minimum starting balance of ₦100.

Find out more about Cowrywise here.

Sumo Trust

Sumo Trust is a digital investment platform that promises high yields on savings made with it. Users can save as little as ₦100, daily until they reach their target savings. They can also do this on a weekly and monthly basis.

This app offers interest rates exceeding 10% per annum. Its ‘Fixed Deposit’ account may achieve annual returns of up to 15%.

Chaka

Chaka lets you buy company stocks domiciled in over 40 countries, including Nigeria and the United States.

The minimum amount needed to begin buying shares is $10. Although the entry requirement is a bit stringent (you need to provide your BVN, national ID, and a document that proves your address), the app boasts one of the best functionalities of the options available.

There’s more on Chaka here.

Find our comprehensive listings of businesses in Nigeria here https://businesses.connectnigeria.com/

Trove

With Trove, you can buy and sell over 4,000 financial instruments in exchanges across the world. This includes stocks, REITs, and ETFs. They have also recently added cryptocurrencies to the list of assets tradable on the platform.

If you’re a novice concerning the stock market, you can practice buying and selling stocks on Trove’s dummy account, before getting in on the real thing.

PiggyVest

This is one of the more popular savings and investment apps in Nigeria.

Its savings plans include Core Savings, Target Savings, and SafeLock. Each comes with varying maximum interest rates. Investify, which is PiggyVest’s investment product, allows users to earn more by investing in low-medium risk opportunities.

Read more about PiggyVest here.

Crowdyvest (FarmCrowdy)

If you want a piece of the action in the agribusiness space—and profits to go with it –you should consider using CrowdyVest.

This tool lets you invest in a range of agribusiness projects, from farming to livestock processing and produce trading. You get video, photo, and text updates on the projects you invest in and receive a fixed percentage of the profits made from the project at the end of the investment cycle.

There’s more about FarmCrowdy here.

MeriTrade

MeriTrade is a digital stockbroking platform that enables its users to buy and sell securities on the Nigerian Stock Exchange. With it, you can view live market data, get stock recommendations, and make quick trades. These services are available on both the MeriTrade app and online portal.

You need a minimum of N10,000 to open a trading account with MeriTrade. They also require some standard means of identification (drivers’ license, national ID, or permanent voter’s card) and proof of residential address.

MeriTrade is backed by Meristem, a stockbroking firm licensed by the Securities and Exchange Commission (SEC).

ALAT by WEMA

ALAT isn’t primarily an investment app. It’s a ‘digital bank’ powered by WEMA bank and provides a range of banking services including account opening, bill payments, collateral-free loans, and bank card delivery.

But its personal and group savings plans enable its users to earn an annual interest of up to 10% on funds held with it.

Find out more about ALAT here.

Final Words

These investment apps can be downloaded on Google Play Store. Be sure to do your due diligence before settling for any of them. They could be your gateway to a future of greater financial independence.

Featured Image Source: ALAT

Got a suggestion? Contact us: [email protected]