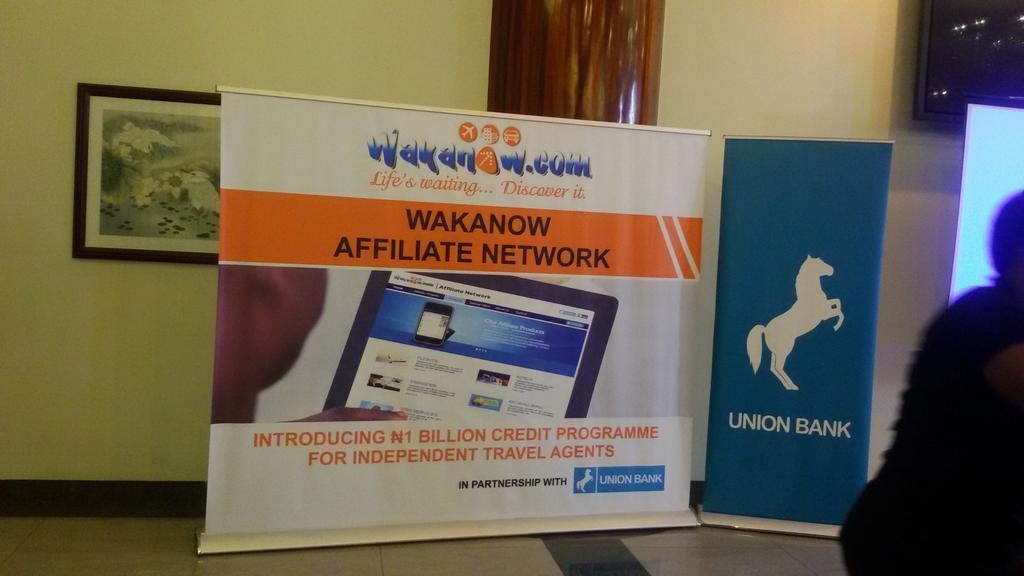

On July 17, 2014 in Lagos, Union Bank of Nigeria Plc entered into partnership with Wakanow.com to provide a global limit of a one billion (N1 billion) naira overdraft with one million (N1 billion) or more per affiliate/ agent subject to performance.

At the presentation of Union bank`s offer, Kingsley Ulinfun, Head of Commercial Banking and Regional Executive said that Union bank is excited about this partnership as it gives the bank an opportunity to work with growing businesses and expose the banks revamped services. He mentioned that this partnership is about growth; Growth for the Affiliates, Growth for Wakanow and Growth for Union Bank.

The partnership is structured to provide funding to qualified agents/affiliates of Wakanow to improve business turnover and grow their margins. In addition, making funding more accessible to this market segment will led to expansion of the travel industry as a whole.

To qualify for this partnership scheme, the existing Wakanow sub Agents/ Affiliates must be a registered Nigerian company in existence for a minimum of two years with a monthly sales figure of N2 million and a clean credit bureau record.

Union Bank believes partnerships like these are key to the development of industries across the country. The coming together of different industries to achieve economic empowerment across different segments of society remains the ultimate objective of these initiatives.