Online fraud causes financial losses to people worldwide, which is why payment systems and major banks employ advanced technologies for protection. These systems automatically block all transactions from Nigeria, Botswana, and South Africa. However, just like anyone else, residents of these and other African countries need to pay for apps, software, and digital services. Moreover, they can fall victim to online fraud just like people from any other country. These issues are addressed by virtual dollar payment cards from PSTNET. These cards are called Ultima. Ultima cards are available to every resident of the continent. Let’s explore their features and benefits and find out how easy it is to get such a card.

Read more about FinTech

The Ultima Cards: Key Features and Benefits

The financial platform PSTNET issues virtual cards for various purposes, such as media buying on Facebook, Google, Microsoft, TikTok, and other platforms. The Ultima card is a universal dollar card for purchases.

All cards from the service support the most popular currencies – the US dollar and the euro. They can be linked to Apple Pay or Google Pay and used anywhere Visa or Mastercard is accepted. The main advantage of Ultima cards is that there are no limits on purchases or top-ups.

Security is another significant benefit of the PSTNET service. Ultima cards provide a high level of personal data protection. They are integrated with 3D Secure technology, which ensures that each transaction is confirmed by a special code sent via Telegram bot or SMS to the cardholder. Additionally, the service uses two-factor authentication to safeguard user data.

In any case, if necessary, the card can be instantly blocked via the user’s account. This can be done in just a few clicks.

Card Fees:

- 0% for transactions

- 0% for withdrawals

- 0% for operations involving frozen or blocked cards

- 2% for top-ups, regardless of the method

The PSTNET Service: Issuing the Ultima Card, Balance Top-up, and Customer Support

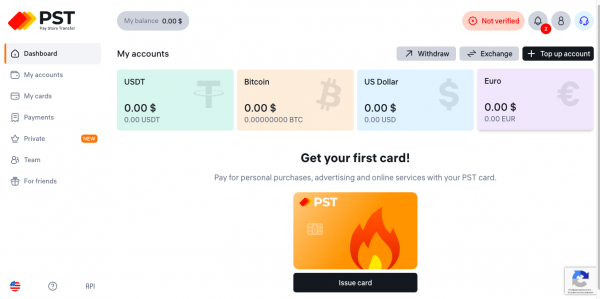

To get your first Ultima card, you need to register on the PSTNET platform. You can do this using your Google, Telegram, WhatsApp, Apple ID, or email account. The process takes just a couple of minutes.

After registration, you will be directed to your account, where you’ll see your balances in dollars, euros, and cryptocurrencies. There, you’ll also find the option to “get an Ultima card.” Once issued, the card becomes active immediately. All you need to do is fund it.

Three Methods to Top Up Your Card:

- 18 cryptocurrencies: BTC, USDT (TRC 20, ERC 20), and others

- SEPA/SWIFT bank transfer

- Transfers from other Visa/MasterCard cards

Interaction with the Service

- Technical Support: 24/7 support through Telegram chat and other communication channels.

- Telegram Bot: For service notifications and 3D Secure codes.

Conclusion

In summary, the advantages of the Ultima card include quick issuance without the need for documents or user verification, no fees for transactions, withdrawals, or operations on frozen cards, and no limits on spending and top-ups. The card also features 3D Secure technology and two-factor authentication, which effectively protects cardholders’ funds from fraudsters.

Overall, it is reasonable to expect that security technologies will only improve in the coming years. For instance, according to Statista, the financial market will invest over $100 billion in fraud prevention by 2027. This statistic is also referenced by Forbes in its “35 Statistical Facts About E-commerce in 2024.”

Register to attend the CN Business Mixer

In general, Visa payment systems have always prioritised the security of their cards. Therefore, choosing the Ultima dollar card, supported by the Visa payment system, will allow you to have peace of mind about your funds while making online purchases on international websites.

Got a suggestion? Contact us: [email protected]