Most adults want to be financially free and stable. Not just in their personal finance but also in their businesses. Having a thriving business may improve your chances of being stable financially but it does not guarantee it. If you don’t manage money properly, you can run into huge debts. And find yourself back to square one.

Read more about Fintech

Therefore, Learning how to manage your finances will safeguard you and your business from debts and bankruptcy. This is what Finance management apps help you to do.

Here Are Trusted Apps To Manage Your Finances

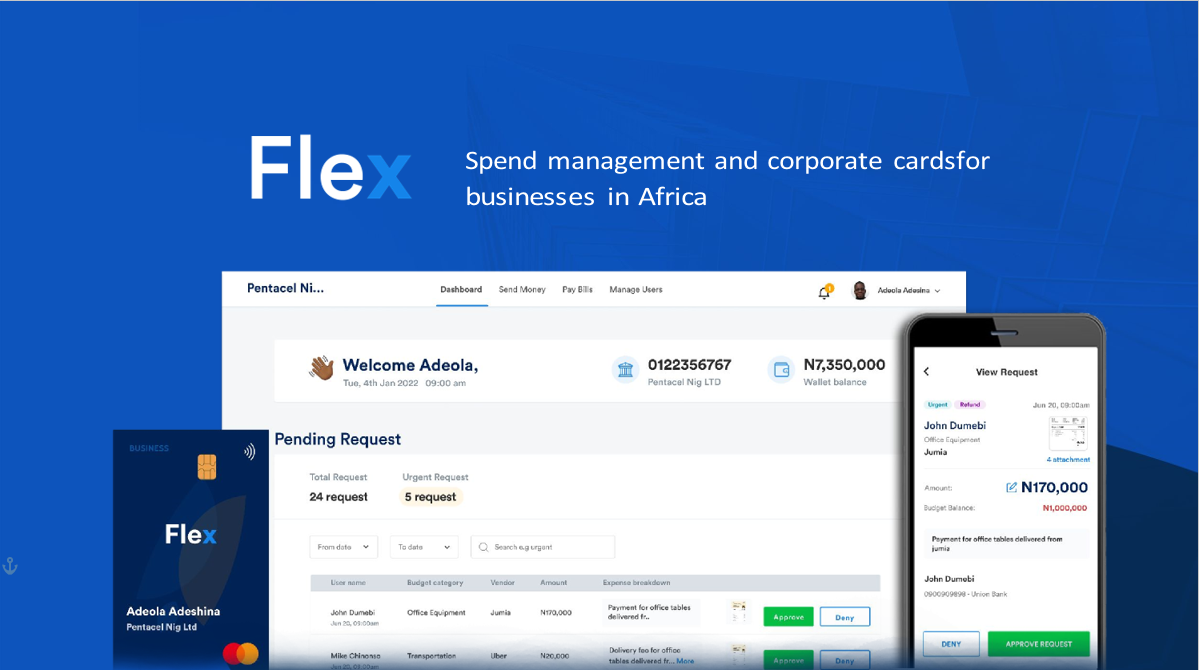

Flex Finance

Flex Finance is a Lagos-based Nigerian Fintech startup founded by Yemi Olulana. Its mobile application help SME owners and solo entrepreneurs manage and track their business expenses and finance. If you are a business owner, you can easily, safely and conveniently manage your business finance right on your smartphone or laptop. You can equally make bulk transfers, track expenses and approve and disburse requests of your customers.

Sign up for the Connect Nigeria daily newsletter

Kippa

Kippa Is a Nigerian-based finance management startup. It was founded by Kennedy Ekezie, Duke Ekezie and Jephthah Uche. Its app wants to help small business owners improve the life cycle of their businesses. One of the reasons several small businesses closes down is because they couldn’t manage their finances. Thus, Kippa is an avid remedy to this situation. As a business owner, you can use kippa to track daily income and expense transactions, create invoices and receipts, and manage the inventory of your business.

Register to attend the Connect Nigeria Business Mixer

In addition, it generally monitors how your businesses ebb and flow over time. Perhaps one of the app’s most important features is that it helps you to keep track of debtors and send automated reminders to them. If you use Kippa this way, you will “recover debts 3x faster.”

Sparkle Nigeria

Sparkle Nigeria is a neo bank owned by Uzoma Dozie. It provides banked but unsatisfied individuals with a platform to pay bills, save, top-ups, and request or send funds. Sparkle doesn’t provide financial services to its customers. They also provide both lifestyle and business support services to Nigerians. Its product Sparkle Business aids business owners with financial management tools. As a business owner, sparkle business helps you to do inventory, invoice management, tax advice, and payroll and employee management services. All you need to do to access this is a tax identification number (TIN) and an email address.

The importance of managing finances cannot be overemphasized. Every day, several businesses close down due to bankruptcy. This is why tech companies have created apps that simplify the process and make it easy for users to track their incomes, expenses etc. Do well to choose any of the mentioned if you want your business to thrive. They will not only save your business but will also improve its condition.

Featured Image Source: Financial Market News

Got a suggestion? Contact us: [email protected]