FBN Holding Plc Tuesday announced a dividend of N1.10 per share for the year ended December 31, 2013, showing an increase of 10 per cent above the N1.00 paid the year before.

The dividend, which amounts to N35.895 billion will be paid out of profit after tax recorded by FBN Holdings for the year. The audited results made available yesterday showed that the financial institution ended 2013 with gross earnings of N395.9 billion, which is up seven per cent from N370.2 billion posted in 2012.

Interest income rose by 10 per cent from N295.4 billion to N323.6 billion. While FBN Holdings tried to control operating expenses, which fell by four per cent from N193.5 billion to N185 billion, high impairment charge of N20.3 billion affected the bottom-line. Consequently, FBN Holding recorded profit after tax of N70.6 billion compared to N76.8 billion in 2012.

Additional analysis of the results imply that the company witnessed an increase of 22 per cent in customers’ deposit, rising from N2.395 trillion to N2.929 trillion.

Loans to customers grew by 15 per cent from N1.541 trillion to N1.769 trillion, while total assets also rose by 20 per cent from N3.228 trillion to N3.871 trillion.

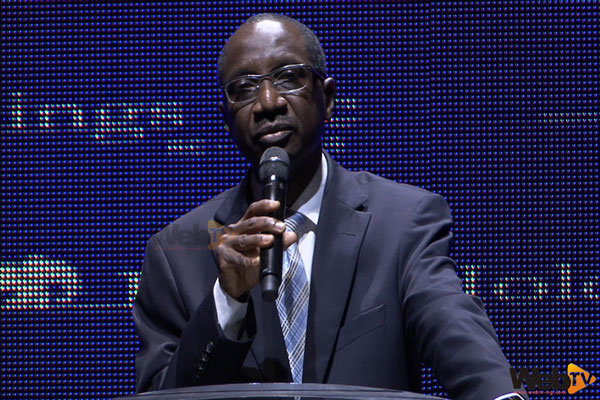

Regarding the results, the Chief Executive Officer of FBN Holdings, Bello Maccido, said the predominant theme over the course of 2013 was one of moderate economic growth within the context of significant regulatory changes in our sector.

“Our financial performance was impacted largely due to revised banking charges, whilst the increase in the cash reserve ratio (CRR) impacted our overall performance as reflected through FirstBank, our flagship subsidiary.

“During 2013, whilst the Group delivered a year-on-year rise in gross earnings of 7.0 per cent to N395.9 billion, profit before tax dipped marginally by three to N91.3 billion,” he said.

According to him, the diversification and strong natural synergies, in turn, reduce risk and improve the quality of the company’s earnings.

“With the recent acquisition of ICB banks across four West African countries, the acquisition of Oasis Insurance and our on-going effort to strengthen the investment banking and asset management business through the acquisition of a merchant banking license, the Group is on track to deliver on its promises to its various stakeholders,” Maccido said.